Link for viewing this newsletter in separate window outside of email

This is probably going to be my favorite newsletter I do each quarter, as I’ll be able to talk in long form on my portfolio, what I’ve learned, and what my plan is moving forward.

I don’t expect these to be my most viewed newsletters and are more a blog, but being able to include the nuance in my investing strategy without worrying about character limit on twitter is something I highly enjoy.

First, An Overview

With this being my last newsletter for Q3 ‘21 and the cycle of topics resetting soon, I thought I would start with just saying thank you to all of you who signed up for these and read them. I didn’t think I would have this much fun!

I made this newsletter not because I think I’m an amazing investor, but it’s quite the opposite. The biggest change in my investing lifetime was creating my fintwit account which forced me to deeply question everything I was doing and expand my horizons to much different thoughts, ideas and ways of thinking. The goal of this newsletter was something very similar: to force me to become a better investor through being vulnerable and articulating my thoughts. I guess there’s also the side of myself absolutely hating character limits when explaining data and the context with them…

I think I like how this quarter flowed with the schedule of newsletters coming out, I try not to force out content and want it to be value add. I genuinely appreciate the 430+ people that have signed up for these!

What I’ve Learned

Averaging Up is Powerful - This was something that I was never comfortable with since I bought my first stock in January of 2020. For some reason my mind would go to averaging down on stocks I believed in that might be misunderstood, didn’t execute to the standard the market was looking for that Q, or just regular price action. I think for yourself to do that, you REALLY need to understand the company and/or strong thesis which isn’t something I’ve always had. More times than not, Wall St is trying to tell you something when a stock keeps going down in my opinion.

Less is More - I’ve found the concept of being concentrated into 8-12 companies that you deeply understand is the ideal way to go about investing for someone like me. This let’s you quickly react to news, and is just a better way of wealth accumulation versus maintaining wealth. I had upwards of 25 positions at different points in my journey where I now only have 11 and very happy with that number.

You probably would think what I meant by that subtitle is sitting tight and little portfolio activity. I’m actually of the opinion that there can be serious alpha generated by managing positions outside of a base as things run wild, or trading oversold bounces, or using instruments like covered calls. I would only suggest doing this for tickers that you know really well over time and not new positions. I do this a lot with my SoFi position.

Relative Underperformance Isn’t a Red Flag - One of the things that really threw my mind in a blender is when I looked at this thread of the best performers over the last 15 years. The thread showed how much they underperformed the S&P in certain years throughout that period. The underlying theme is that when a stock outperforms the market in a given year, it really outperforms then goes through a period of digesting that move until the next move. The caveat here is that the stock did outperform the market for a stretch haha.

SaaS, Cloud Infrastructure Companies Here to Stay - Now this is probably my most obvious learning I’ve had this year but still worth saying as I’ve only truly seen the light recently. These companies are special in the fact they can seamlessly scale without hard cap resources like manufacturing capacity, headcount, or even hardware sold. Their product development and innovation is something I admire!

My premise with most of these cloud infrastructure companies especially is that they will continue to grow 20%+ for many years in the future even as they mature (see FAAMG). Not every single one will be like that, but it’ll be extremely fruitful to own the ones that do, even from this point on in my opinion!

It’s very easy to just brush these companies off as a sign of a bubble but I think the market is giving them the respect they deserve (lets see how that take shakes out through tapering haha). If we see a big taper tantrum with these high-growth names, you betcha I’ll be going overweight into the space!

If You Love Everything But the Valuation, Buy a Little With Room for More - This is especially true if:

The opportunity the company is tackling is very large

The company is in hyper-growth stage still (revenue growth 50%+)

The company market cap is sub 20B

I think this plays into the saying “you get what you pay for” where quality is expansive in the market! Best example I have for this is myself being enamored with Lightspeed (LSPD) at the beginning of July when it was in the high 70s-low 80s, I was really turned off by valuation. Since then I’ve made it my largest position after doing the work on them and has been my most profitable investment so far in my young career.

It’s so easy to try and play the 2nd or 3rd tier players in a given sector where there is probably some attractive multiple arbitrage, but I try to tell myself it’ll be an extremely frustrating experience as an investor taking on that strategy where those companies “might not be invited to the party” (Ho Nam is a treasure on Twitter).

My Portfolio

I share my portfolio holdings and activity every week and a combined look every month found on my twitter across all of my accounts. I think investing in public and using my twitter as an open diary is a great way to grow and is something I’ve really enjoyed doing!

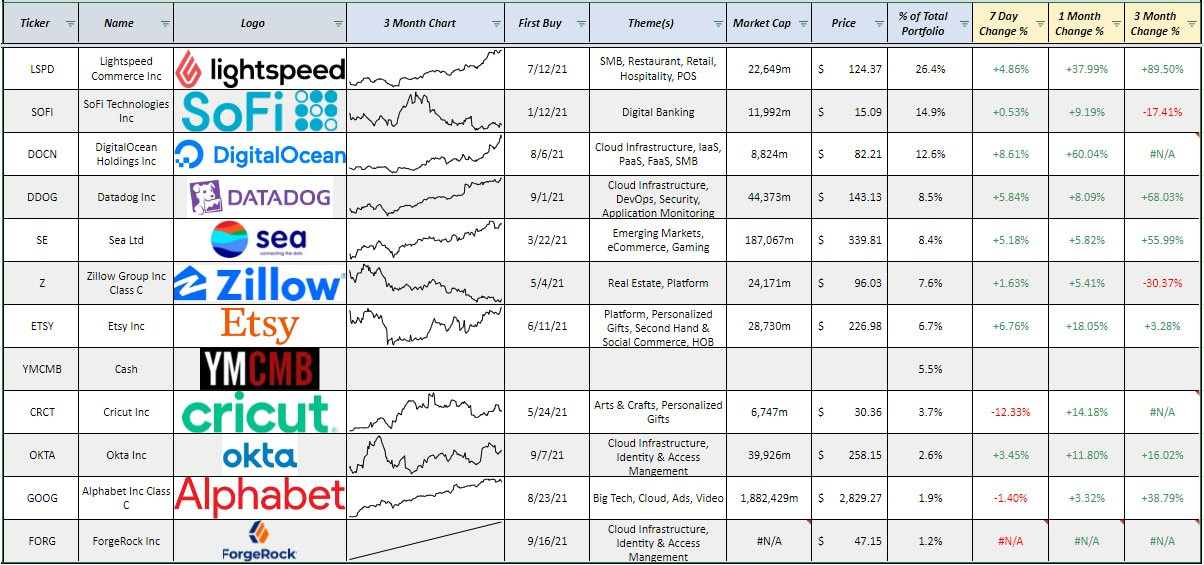

Here is a top level look at all 11 of my holdings spread throughout my Roth IRA, Taxable Accounts and HSA as of 9/18/2021. As you can tell I’m a big fan of tax advantaged accounts and lends into my investment strategy in that I’m trying to build wealth, not get rich by tomorrow.

General Thoughts

I’m still in quite an early stage of my professional career where each deposit I make swings my portfolio quite drastically (which is quite fun). I have created this portfolio with the idea that I could average up and DCA into each and every name and not be worried for the long term.

I’m extremely pleased with the names I’m holding as I know each one of them quite well, but especially at the top! I think I have exposure to all of the sectors and themes that I’m looking for, it’s just a matter of building out those positions further and the weighting of each that will change.

I’m not much of a DCF type investor as I don’t think that’s my strong suit. I look at their Gross Profit & (hopefully) EBITDA multiples, projected growth, if a company exceeds expectations each quarter, if wall st revises their estimates to the upside often, past execution of management, product development and innovation, status in their market and topics like that.

You can tell from the date of my first purchase, I only just became of the long term investing mindset this year around February. Basically took me a full year in the market to figure that out! I’ve gone in and out of many positions whether I entered them with the intentions of a swing trade or long term investment, and feel quite good about the ones I’ve let go. Just for fun I’ll highlight those names below as it gives some insights on themes I’ve decided to stay away from now, like the auto industry.

Companies I’ve Owned But Sold: This is a general list of companies I’ve been long at one time or another in the last 1.75 years. Genius Sports (GENI), Shake Shack (SHAK), Redfin (RDFN), Coupang (CPNG), Poshmark (POSH), Olo Inc (OLO), Grab (AGC), WeedMaps (MAPS), Penn National Gaming (PENN), Square Inc (SQ), Microsoft (MSFT), Nvidia (NVDA), UPS (UPS), Home Depot (HD), Upstart (UPST), Lucid Motors (LCID), Proterra (PTRA), Tesla (TSLA)

Companies I’m Eyeing (in no order): Shake Shack (SHAK), DutchBros (BROS), Crowdstrike (CRWD), Snowflake (SNOW), Elastic (ESTC), WeedMaps (MAPS), Mitek Systems (MITK), Toast POS (TOST), Twilio (TWLO)

Lightspeed Commerce (LSPD)

Percentage of Portfolio: 26.4%

First Buy: 7/12/2021

Last Buy: 8/24/2021

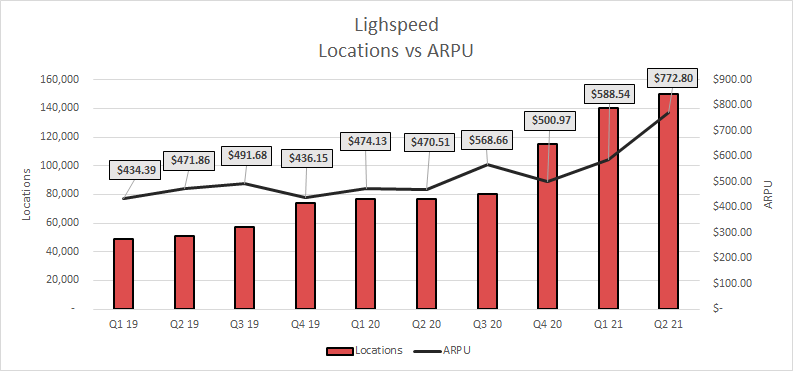

Why I Invested: I think this will be the shortest section since my last newsletter post was a Lightspeed Deep Dive and it highlights quite in depth why I invested. I really couldn’t be more excited to own this company long term with the drastic changes we’ve seen to the restaurant, retail and hospitality sectors due to COVID. Their combination of great execution, aggressive M&A strategy, being very well capitalized and a young CEO/Founder with 10% stake in the company sums it up as best I can.

My Plan Moving Forward: I’m looking to still greatly add to this position over time, although I haven’t since the $90’s. Nothing against them, just trying to build out other positions currently and there’s no doubt this has quite a stretched valuation after the impressive run it’s been on.

SoFi Technologies (SOFI)

Percentage of Portfolio: 14.9%

First Buy: 1/12/2021

Last Buy: 7/20/2021

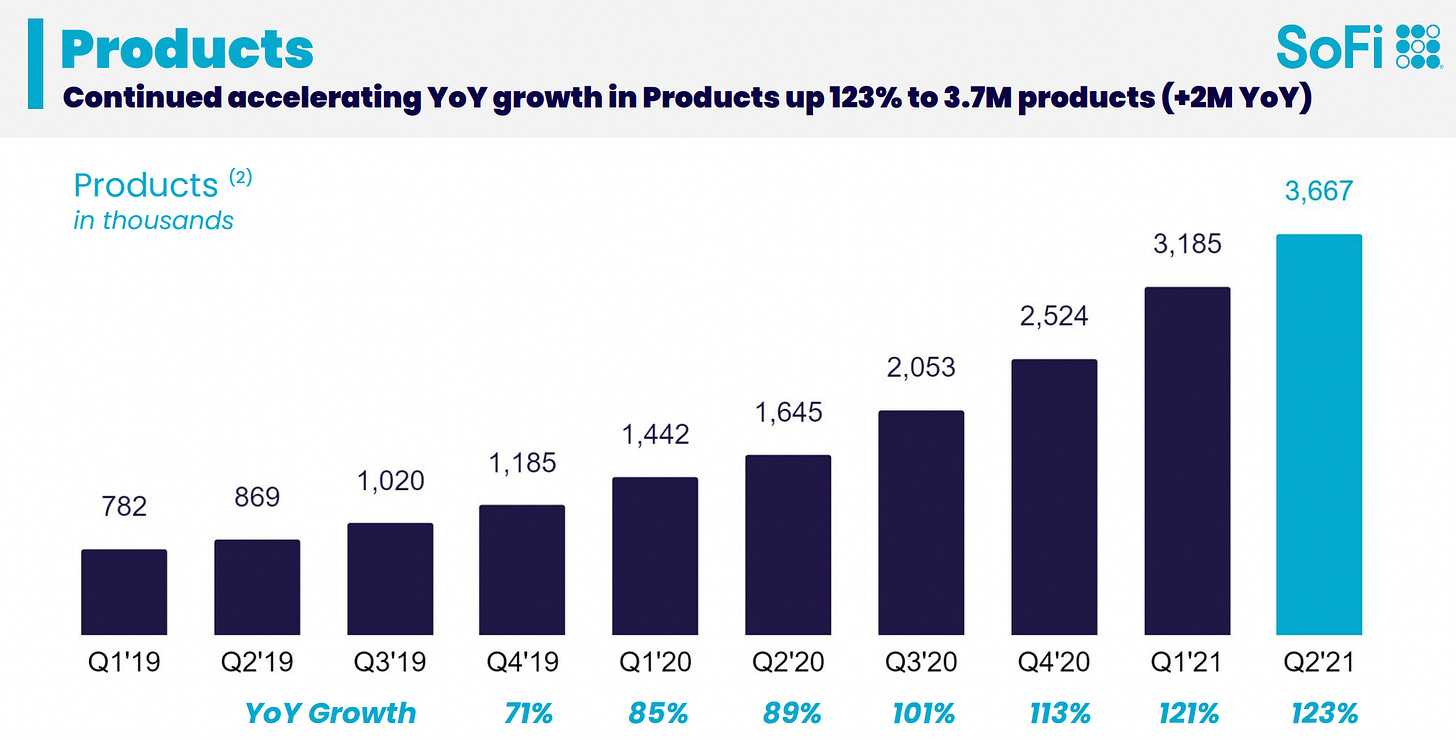

Why I Invested: Now this is my longest hold and was 27% of my portfolio at one point. I use SoFi for all my banking and think they are the most likely company to snatch people away from traditional banking versus PayPal or Square with a full consumer platform. I couldn’t be happier as a customer. With that said, as you can tell this was more of a purchase about the idea of the company more than anything it’s reporting quarterly or showing up on their income statement.

I only say that in the manner that it’s a top 3 position for me, not the fact that I own them at all. They’re growing rapidly and I’ll be holding this company for a long, long time, but I didn’t have as refined of a decision making process as I do now when I built most of my position here in January and February (you can imagine how that’s worked out).

I still am very excited about this company as it gives me exposure to digital banking, lending, credit, B2B issuance with Galileo on a global scale, and a small play on Crypto with their Invest platform. This is a company that was built on student loan re-finance until the launch of their consumer platform in 2018, so there is a large shift of revenue streams happening as shown below.

My Plan Moving Forward: I’ve decided this is more of a moonshot holding where if network effects snowball and if Galileo continues to execute, this will be an incredible investment. But if that doesn’t happen, there’s a real chance this gets left behind due to fierce competition in the Fintech space. I think this will naturally make its way down to the lower half of my portfolio in time by simply adding to other positions and have to prove itself to make its way up.

DigitalOcean (DOCN)

Percentage of Portfolio: 12.6%

First Buy: 8/6/2021

Last Buy: 9/14/2021

Why I Invested: I’ve always been interested in investing in a pure-play Infrastructure-as-a-Service (IaaS) company versus the big dogs like AWS, Azure & GCP. DigitalOcean is an incredibly lean company where they have a Gross Margin Adj Paypack period of just 5 months where the average for SaaS companies’ GM Adj Payback period is about 25 months!

This story is still unfolding as they now have access to capital they never had with their IPO earlier this year, where they just made their first acquisition recently for the Serverless, Function-as-a-Service (FaaS) company Nimbella for an undisclosed amount. This is a rare company where they spend more on R&D than they do S&M which is music to my ears.

With DigitalOcean focusing on SMB’s - churn and small spend per customer are real risks, but shown at the bottom you can see DigitalOcean is seeing accelerating sequential growth in revenue, ARPU, and NDRR.

My Plan Moving Forward: This is a position that’s greatly appreciated in recent weeks but luckily I realized the opportunity and reasonable valuation this company had just before it really took off and built it into a much more real position! I usually build sizable positions much slower but this was an exception.

I just added more to my Roth IRA position last week at $74 and plan to continue to buyer over the coming months when new money hits my account.

Datadog (DDOG)

Percentage of Portfolio: 8.5%

First Buy: 9/1/2021

Last Buy: 9/16/2021

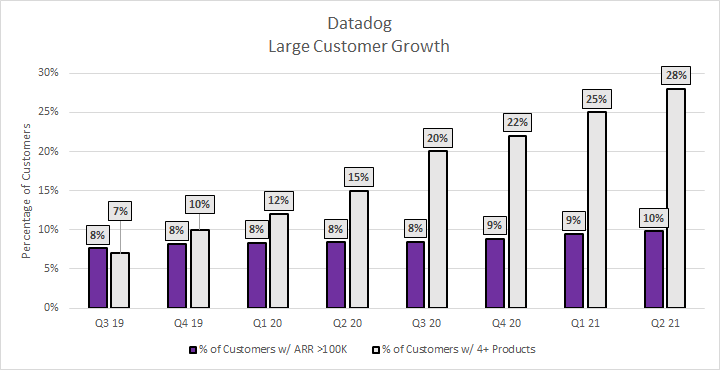

Why I Invested: This was a very fun story how I became interested in Datadog. In my “Operating Expense Analysis” newsletter, they stood out the most to me with an interesting combination of an increasing research & development spend as a % of revenues versus declining sales & marketing spend as a % of revenues. Even better, their R&D spend outpaced their revenue growth from 2018-2020! This is another company where they spend more on R&D than they do S&M, as well as a 9 month GM adj payback period. I’d say this is the definition of a product-led company.

From that beginning intrigue in the OpEx Analysis newsletter, I started following them and wanted to see how their Q2 earnings report was to validate the story the income statement told, and yes it did! They’ve rolled out 6 of their 13 total monetizable products over the last two years and had a blowout quarter with a beat and raised guidance. I was a little caught up in building out my LSPD position and then DOCN position but then came back to them as I noticed they hung around after their post-earnings gap up.

I’ve been learning about what they do and the spaces they play in and it only solidified my thoughts that this is a special company that lets their product do the talking vs large marketing campaigns. I see the cloud observability and security sectors with a great deal of optionality and demand for the future, and don’t see Datadog slowing down anytime soon. Their customers are some high growing companies that will only need more IT support as they continue to grow such as DraftKings, Coinbase, Fanduel, Peloton, Zillow, Twilio, SoFi and many more.

There is just something special about their go-to-market strategy where new customers start small with 1 or 2 products, but only expand from there. This is best captured by Datadog’s last earnings report where they stated 70% of their revenue growth simply came from existing customers. This has a snowball effect as they still bring on a considerable amount of new customers, where they have sequentially grown revenues the last two quarters.

If you’re looking to learn more about them, here are my top recommendations from Peter Offringa at SoftwareStackInvesting (who is an absolute treasure for his free research).

I also recently did a KPI and Income Statement thread on them on twitter.

My Plan Moving Forward: This was a company where I never would’ve bought into a year ago or even earlier this year as it’s sitting at ATH’s and is almost a double from its May lows (congrats anyone who got some of that). My conviction and understanding is high enough to feel very comfortable buying at these prices and will continue to do so over time. If I could hope for any company to correct 20-30% it would be this one and I would go very overweight with little hesitation!

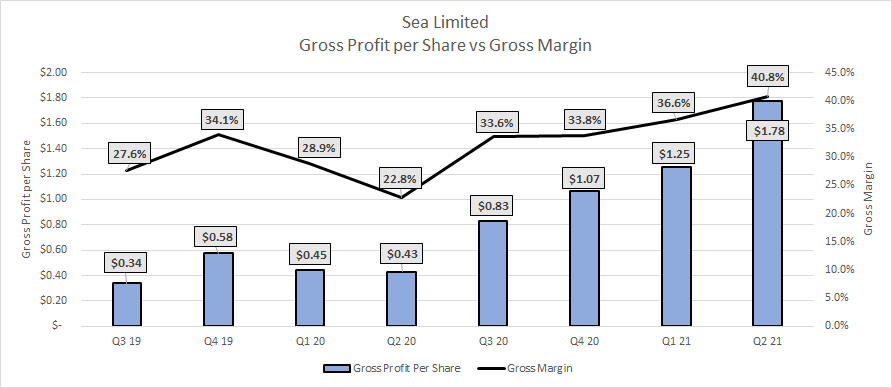

Sea Limited (SE)

Percentage of Portfolio: 8.4%

First Buy: 3/22/2021

Last Buy: 7/28/2021

Why I Invested: I don’t think I need to sell this one all too much as most are familiar with the beast that is Sea Limited. I actually owned this name last June at $110 when I didn’t have the slighted clue of what I was doing or any process to judge a company and didn’t know one thing about the company (I think I liked their ticker when I saw a post on WSB mentioning it LOL).

Luckily when every growth stock was tanking earlier this year in February and March, I really took the time to understand this exciting company and it ticked off so many exposure boxes I wanted:

Gaming

eCommerce

Emerging Markets

Underbanked Digital Banking

Strong Founder Led

From that point, I continually built a position in the low 200’s and high 190’s which has obviously worked out quite well for me. This company just executes and exceeds (high) expectations regularly.

My Plan Moving Forward: I wouldn’t be lying if I said their recent plans to expand into India and now Europe with Poland didn’t worry me. If this company wasn’t such a compelling story with great leadership I probably would’ve taken my large gains and ran, but I’ve decided I’ll simply monitor their execution while doing nothing (no selling, no buying).

When I feel comfortable again that they aren’t burning intense amounts of cash and that they can actually make Shopee into a profitable business unit with these new regions, I’ll start buying again. I have the upmost faith in Forrest Li, how could you not?

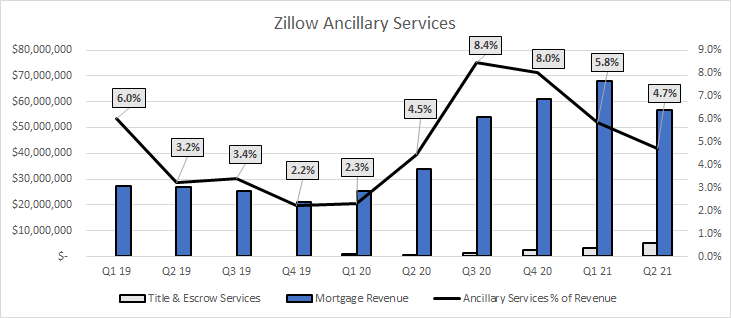

Zillow Group (Z/ZG)

Percentage of Portfolio: 7.6%

First Buy: 5/4/2021

Last Buy: 8/20/2021

Why I Invested: Real Estate is a sector that hits close to home as my mom is a RE agent and my dad is as well now since he retired from B2B sales in the last 5 years. Seeing this industry up close, this is absolutely ripe for a big shake-up and I feel most comfortable with Zillow being a large part of that (as they already have been).

This is a long road ahead since this is a highly regulated market where each region has different winners and players. I’m not expecting this story to develop out in under 3 years, but more like 5-10+ years. Zillow is best positioned to succeed and weather the storm with their internal cash cow IMT business that these other RE disruptors don’t have like Redfin and Opendoor.

I did a pretty decent thread on them a month or so back that best explains their strong positioning and momentum within their Zillow 1.0 and Zillow 2.0 business segments.

My Plan Moving Forward: This is a delicate market and position where wall street is screaming at us they aren’t buying Zillow’s success over the last three quarters and are forward-looking to the headwinds these RE tech companies will be facing. The fun part about all these constant discussions we see on Fintwit of Zillow vs Redfin vs Opendoor blah blah blah is that they trade the exact same over the last two years! (more so Zillow vs Redfin).

I got a little excited buying dips in the low 90’s over the last two months and realized I’m in no rush to build this position with the given macro headwinds ahead. Since then I’ve trimmed this position back into what it was before those buys and plan on focusing on other positions to build and add to.

Etsy (ETSY)

Percentage of Portfolio: 6.7%

First Buy: 6/11/2021

Last Buy: 8/4/2021

Why I Invested: At one point I was incredibly overweight in these second hand ecommerce, personalized gifts trends owning names like Etsy, Pinterest, Poshmark, RealReal, Cricut, so obviously you can tell this is a trend I believe in.

What really changed is Etsy acquiring Depop, the second-hand eCommerce and Poshmark competitor in the UK. I really like the House-of-Brands approach Etsy is taking with its flagship Esty brand, Depop and Reverb. Combine that with a strong founder lead management team to execute this vision and I felt I could get that upside owning just Etsy.

Etsy dominates their niche for SMBs selling personalized gifts or arts & crafts where they have extremely efficient unit economics and are well capitalized to continue this dominant position moving forward. This is a company I sleep very well at night owning!

My Plan Moving Forward: I think I’m done adding to this position for some time until I’ve continued to build out other positions at a higher priority, but no doubt plan on continuing buying into the future. They had a so-so quarter after a large pull-forward from COVID tailwinds so I want to monitor how they execute moving forward.

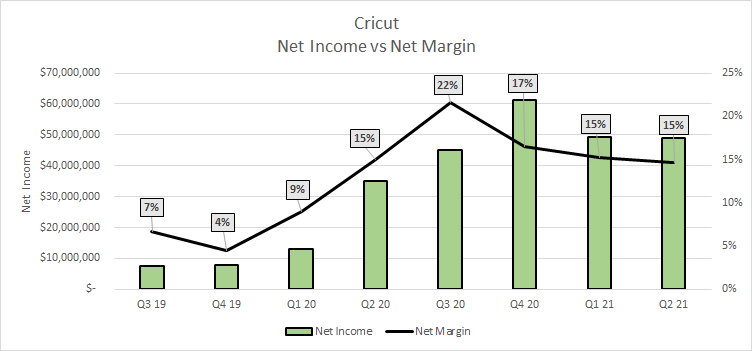

Cricut (CRCT)

Percentage of Portfolio: 3.7%

First Buy: 5/24/2021

Last Buy: 7/14/2021

Why I Invested: Cricut is probably the least known name that I own but I’m a big believer in their connected printers flywheel with their subscription model and materials and accessories offerings. This is a true Razor vs Razor Blades model where the connected printer is what draws new customers in with a low margin offering, and the other two segments are much higher margin and are continued purchases. They are extremely profitable on a net margin basis and I don’t see this as an overall risky name to own.

I first found out about this company watching YouTube with my girlfriend where one of the DIY channels she watches had a sponsored video with them. This immediately caught my eye as I think this is the smartest marketing strategy for a company like Cricut. They also have a very strong presence on other social media avenues like TikTok and Instragram.

We have since bought the Cricut Explore Air 2 and the Easy Press 2 and absolutely love it. My girlfriend has actually made an Etsy store since buying it and has a blast making stickers, shirts, decorated glasses and mugs.

My Plan Moving Forward: I got a little crazy with my buying here when I was first learning more about them that I got a little blinded. I feel much more comfortable with my position sizing now as we still have negative events upcoming such as the 9/24 IPO Lockup.

They had a so-so earnings report but the bulk of the negative movement (in my opinion) came from 25% of the float unlocking from met conditions so I’ve been trimming this position over $30 as lockup approaches this next week. This will probably sit in the bottom third, 5% of portfolio range in the future but I plan on owning them for a long time.

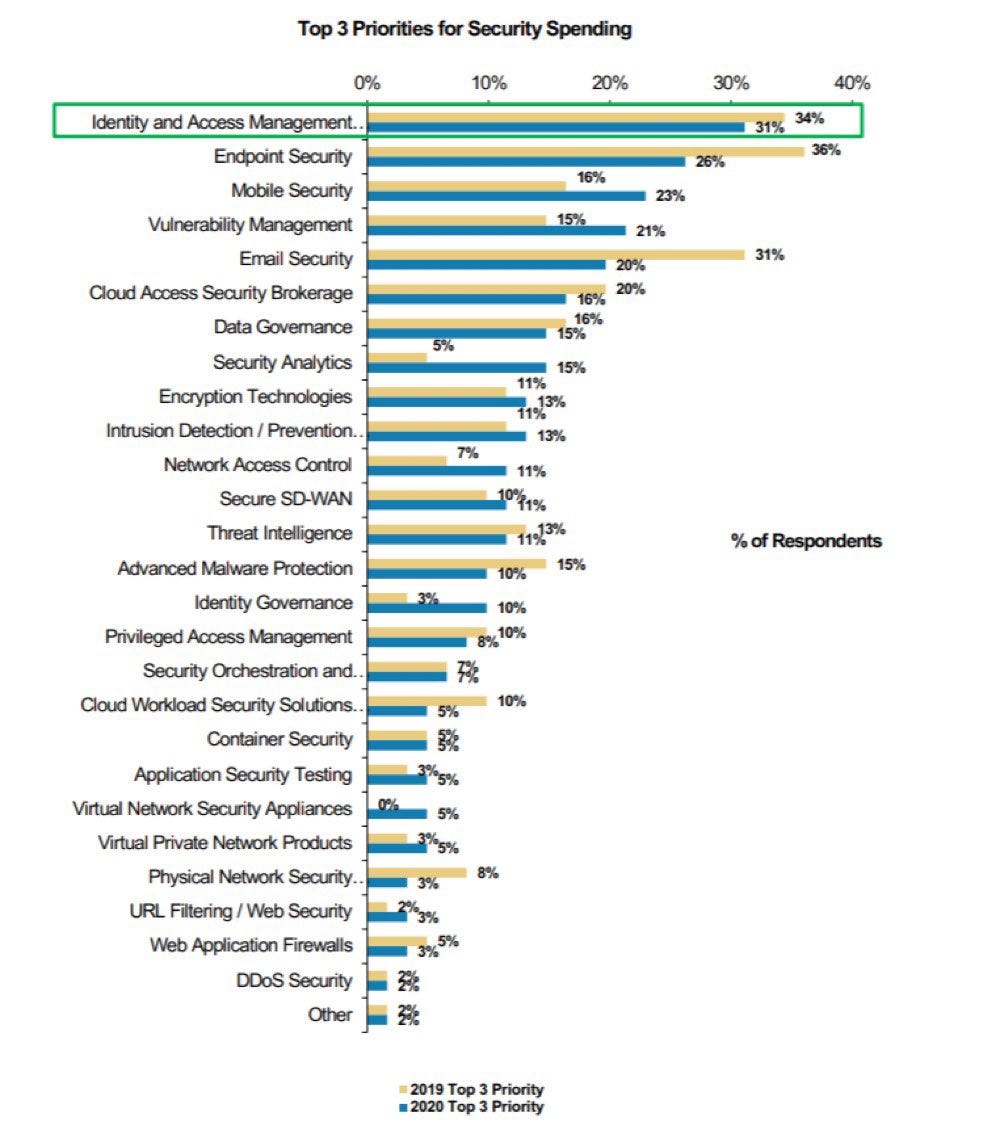

Okta (OKTA)

Percentage of Portfolio: 2.6%

First Buy: 9/7/2021

Last Buy: 9/16/2021

Why I Invested: After I opened up a can of worms with my GOOG, DDOG, and DOCN investments to the world of cloud infrastructure companies, I did more digging and this was another company that stood out to me for their go-to-market approach and general tailwinds around the Identity and Access Management sector (shown below in the ForgeRock section).

I quickly decided that was a sector I wanted exposure to and this was the leader for the cloud based players. Their recent acquisition of Auth0 really excites me in unlocking almost double their previous TAM of $50B now expanding into Customer Identity which adds on another $30B of TAM to bring the total two $80B. What really excites me is that there is an immense cross selling opportunity between the two standalone companies now under one umbrella where Okta and Auth0 only had a 2% customer overlap!

My Plan Moving Forward: This is one of my newer positions and plan on continuing to build out over the coming months, as we’re really seeing some exciting developments that they shared in their last earnings with a 2025 Revenue target of $4B which equates out to a 35%+ CAGR.

I don’t think this will ever be an extremely large % of my portfolio but could level out into the 7% range. This is another company that I’ll sleep like a baby owning as it has a fair valuation compared to others in the cloud infrastructure space paired with a passionate founder/CEO and a large runway.

I will admit I haven’t done as much work on this name compared to the others in my portfolio, which is a continued priority.

Alphabet Inc (GOOG/GOOGL)

Percentage of Portfolio: 1.9%

First Buy: 8/23/2021

Last Buy: 9/7/2021

Why I Invested: I’ve always felt I needed the Mega-Cap tech exposure so I took some time over the last couple months to really decide which of the FAAMG I wanted to DCA into. I’m of the opinion that all five of those companies will continue to be winners for investors, but I really like the prospects with Alphabet.

You get two huge monopolies in Search and YouTube, paired with their Google Cloud Platform that is on the verge of just starting to contribute to their bottom line, then you throw in moonshot bets that aren’t in the valuation at all like Waymo, and yes I can sleep very well owning this company.

There’s also a final dynamic with Alphabet that I like in that they have a large corporate presence in my hometown of Ann Arbor, MI where their founder went to college at University of Michigan. Did this tip the scale? No, but it’s something I enjoy as an investor since they have large offices in the area contributing to the local economy.

My Plan Moving Forward: I plan on buying a small amount of this company every month for a very, very, very long time. I think it’s as simple as that and I’m sure it takes into a larger percentage of my portfolio in time.

ForgeRock (FORG)

Percentage of Portfolio: 1.2%

First Buy: 9/16/2021

Last Buy: 9/16/2021

Why I Invested: As you can see, this is my most recent investment and one I was really looking forward to their upcoming IPO listing this past week. They are an Okta competitor for enterprise customers in the Identity and Access Management space.

ForgeRock isn’t the cloud-native company that Okta is, where ForgeRock has both an on-premise and cloud offering and is transitioning more customers onto that cloud product. This can be a tricky transition as we’ve seen with Datadog competitors like Splunk & Elastic, but I like what I’ve read on ForgeRock and how experts in the area think of them, as seen below.

My Plan Moving Forward: I entered this position with the idea of taking a small basket approach to this Identity and & Access Management space (since I’m no expert here to confidently stock pick), as this company is still quite small in its ARR and market cap and thought it would compliment my Okta holding well. I entered a small position that quickly has appreciated over 30% in two days so I’m not rushing to build on this position as it’s experiencing the classic IPO froth.

This is another name I need to do a ton more work on before I make it into a much more real position, and will most likely let them report a couple earnings before doing so.

Conclusion to Q3 Newsletter Cycle & Plan for Q4

I’m completely open to any feedback on your experience as a reader and any suggestions you’d have for improving these. I’m no expert and still getting comfortable talking about the world of investing!

Here is my general plan for Q4 2021 newsletter cycle:

October 10th - Sector Screens

October 24th - General Screens

November 7th - LinkedIn Company Insights

November 21st - TBD Deep Dive

December 5th - What I’ve Learned and My Portfolio

December 19th - Update on Stocks Highlighted

Thank you for your continued interest in my writing :)

- Sean

This was great, Sean. Really well done!

I admire your strategy and analogy