With this newsletter, the intention is to analyze which tech companies not only talk the talk, but walk the walk when it comes to innovation. The main judgement for this is high research & development spend - an indicator which companies have the best opportunity to create new revenue streams down the road. I believe this is a core factor for an investment to turn into a multi bagger.

Best example of this is the classic Amazon with AWS. They continuously dumped money into R&D for many years in the 2000’s and out popped one of the best and most profitable companies embedded into a juggernaut brand and reach after realizing they do this web services thing pretty well.

At the same time, this will also take a look at if a company is subsidizing their top line growth with an elevated sales, general & administrative spend (something underrated by growth investors).

Before I start this fun exercise, a great point made by a gentleman much smarter than I am on R&D dollar spend not being equal across companies:

Another great article from 2019 on this thought as well.

In the end, I’m just a passionate & naïve 24 year old retail investor analyzing income statements - but there’s zero doubt this should be a main thought while reading through this analysis and making any judgements. Remember, data requires context.

Companies Included

A total of 75 “tech” companies that breakout R&D spend easily in their income statements were looked at for this. These companies in alphabetical order:

AcuityAds (ATY), Adobe (ADBE), Airbnb (ABNB), Amazon (AMZN), Apple (AAPL), Applovin (APP), Atlassian (TEAM), AutoDesk (ADSK), BigCommerce (BIGC), Cloudflare (NET), Coinbase (COIN), ContextLogic (WISH), Coupang (CPNG), Cricut (CRCT), Crowdstrike (CRWD), DataDog (DDOG), Digital Turbine (APPS), D-Local (DLO), Doximity (DOCS), DraftKings (DKNG), Etsy (ETSY), Facebook (FB), Farfetch (FTCH), Fastly (FSLY), Fiverr (FVRR), Genius Sports (GENI), Global-E (GLBE), Google (GOOG), Hubspot (HUBS), Intuit (INTU), Jumia (JMIA), Lightspeed Commerce (LSPD), Magnite (MGNI), Marqeta (MQ), Match Group (MTCH), Mercadolibre (MELI), Microsoft (MSFT), Nvidia (NVDA), Okta (OKTA), Olo (OLO), Palantir (PLTR), Peloton (PTON), Pinterest (PINS), Poshmark (POSH), Pubmatic (PUBM), Redfin (RDFN), Roblox (RBLX), Roku (ROKU), Salesforce (CRM), Sea Limited (SE), Sentinel One (S), ServiceNow (NOW), Shift4 Payments (FOUR), Shopify (SHOP), Skillz (SKLZ), Snap Inc (SNAP), Snowflake (SNOW), Square (SQ), Squarespace (SQSP), Teladoc (TDOC), Tesla (TSLA), The Trade Desk (TDD), Twilio (TWLO), Twitter (TWTR), UiPath (PATH), Unity (U), Upstart (UPST), Upwork (UPWK), Wix (WIX), Zillow Group (Z), Zoom (ZM), ZoomInfo (ZI), Zscaler (ZS)

Methodology

I just briefly want to go over how I did this for transparency purposes. I used secondary sources in Koyfin and Seeking Alpha (I’ve found Yahoo Finance is weirdly off sometimes the more I do exercises like this).

I then pulled the 2018-2020 income statement data and that was my data set. In Excel I then created a big ol pivot table to analyze all this fun stuff. 16 of the above companies didn’t have income statement data for 2018, most of the time due to going public in the last year (ex COIN, DLO, CPNG, SQSP, S etc)

Instead of the more typical R&D Spend as a % of Revenue, I’ll be only using as a % of Gross Profit to normalize companies like Square, Zillow, Redfin and others with wildly different gross profit margins.

I plan on doing this exercise again in Q2 22 once we have fully completed 2021 income statements.

Terminology

R&D - Research & Development

GP - Gross Profit

SG&A - Sales, General & Administrative

CAGR - Compound Annual Growth Rate

OpEx - Operation Expenses (R&D + SG&A)

M&A - Mergers & Acquisitions

Once again remember, data requires context!!

Don’t take all of this at face value, I try my best to explain the data and this is a big reason why I made this substack versus jumbling incomplete thoughts in twitter threads :) The goal of this newsletter in general is thought generation!

Now shall we…

R&D Expense vs Gross Profit

The purpose of this first section is to take a look at companies R&D spend versus their gross profit growth and as a %. Like I said in the introduction, these companies that prioritize investment into R&D are most likely to be the ones who create new revenue streams as time goes on or just greatly improve their product.

First, lets look at the top 10 highest and lowest Total R&D expense as a % of Gross Profit over 2018-2020:

Takeaway

For any company to spend more on R&D than the gross profit they produce over a three year period is quite impressive to me - only Roblox and Snap Inc have that title from this group! You would hope to see known innovative companies Unity and Palantir on a list like this so that’s nice to see as well. Biggest surprise is probably Olo.

Many on the low side of total R&D spend as % of GP are platforms that it might not make sense to be dumping money into this like a SaaS company. The one that does surprise me the most is Upstart since their whole thing is an AI lending platform where you’d think they spend a good amount on R&D. Also surprising to see Zoom on this list.

Another calculation that gives a great snapshot how a company values R&D expenses as it grows is its change as a % of Gross Profit over time. This will be done looking at the CAGR of R&D expense as % of GP.

This table shows the Top 10 increasing R&D expense as % of GP CAGR over 2018-2020 with a small caveat of their 2018 R&D spend as % of GP starting above 10% to remove law of small numbers:

Takeaway

Airbnb jumps out the most here, but unfortunately that is because they had negative GP growth over the last three years while R&D spend accelerated. Still impressive don’t get me wrong but some context behind it.

Intuit is probably the biggest surprise showing up here for me (and so high up), they’ve been a sleeper compounding company and I’m a big fan of Mint. Roblox really loves their R&D spend it seems having the highest beginning % by a longshot.

Now lets get into a full picture of a companies R&D spend. This table has quite a bit going on but in the first column we are comparing a companies R&D Expense CAGR divided by their GP CAGR. This shows if a companies R&D spend growth is outpacing their GP growth or at least keeping up with it.

The second column is what I would view the most important here in that it’s the CAGR of R&D expense as % of GP. Any positive value here is strong IMO.

This table is sorted by Top 25 highest R&D Expense CAGR / Gross Profit CAGR:

Takeaway

WISH looks great here but is deceive since they had an extremely small R&D expense in 2018 that ballooned but their total R&D Spend as % of GP was single digits over 2018-2020 (hello law of small numbers). The most impressive here in my view are Intuit, Roblox, DraftKings, Wix, Lightspeed and Twilio.

Now taking a look at the flipside in the Top 10 lowest R&D Expense CAGR / Gross Profit CAGR multiples:

Takeaway

This is an interesting group of companies where the biggest theme is as their gross profits grew over last three years, their R&D expense as % of GP dramatically shrunk. SNAP I think has the biggest disclaimer here since they went crazy with R&D spend for much of the past 5 years while company top line really took off.

PubMatic looks the worst here IMO since they’re such a small, growing company in the AdTech space where large R&D spend makes total sense, but isn’t prioritizing it to keep up with GP growth.

SG&A Expenses vs Gross Profit

With this section I’ll look at companies in a way that questions, are they maybe subsidizing their growth with an inflated Sales expense or even outpacing it? This will be done comparing SG&A Expense CAGR divided by Gross Profit CAGR.

I think this is something investors in growth companies should be mindful of as well with high CAC etc. What happens when the promos or spend declines, does the company still grow or retain customers?

This table is a bit messy because I wanted to give a more full picture on one’s SG&A spend over the years. I also tried relating total SG&A spend over the last three years to the companies total gross profit over that timeframe with the thought of normalizing the spend across big and small companies.

First, lets look at the top 10 highest and lowest Total SG&A expense as a % of Gross Profit over 2018-2020:

Takeaway

Not surprising names included in the top 10 on both sides. Biggest theme for the smallest % grouping is more mature large to mega market cap companies except for one of my favorites in CRCT.

Hurts to see SE so high up as a bull but I think all bulls know their SG&A spend is quite aggressive. It gets a little more real to see it higher than even DKNG haha. Interesting to see B2B companies like SNOW & PLTR so high up in this as well.

Now looking at the Top 25 sorted by lowest SG&A Expense CAGR / Gross Profit CAGR since you want this multiple to be smallest:

Takeaway

The funny part is Sea Limited is the only one that gets “normalized” using revenue instead of gross profit because in 2018 they had 1.7% gross margin for whatever reason. The total SG&A expense as % of GP shows a more true story here that Sea Limited (Shopee more specifically) is subsidizing its growth to gain market share.

With a little context I think this makes Tesla, Microsoft, Autodesk, Shopify and Cricut look the best.

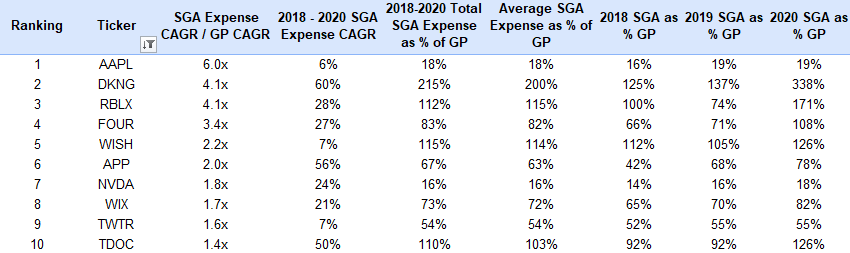

Now looking at Top 10 sorted by highest SG&A Expense CAGR / Gross Profit CAGR:

Takeaway

Apple is about the last company I would expect their SG&A expense CAGR to outpace their Gross Profit CAGR, and 6x at that! But as you can see their total SG&A spend as % of total GP is the lowest along with Nvidia.

DraftKings is the least surprising company on here to me with SG&A CAGR outpacing GP CAGR by 4.1x. Pretty crazy they’ve spent 2x the amount of Gross Profit created over the last three years on SG&A. A big reason why I’m choosing to stay away from this sector as this is a theme. This doesn’t make Roblox and ContextLogic look great IMO as well.

R&D Expenses vs SG&A Expenses

Purpose of this section is to look at what OpEx has grown faster versus the other over the last three years. IMO, a company that has SG&A expenses CAGR outpacing their R&D expense CAGR is at least a yellow flag unless it’s a mature company, there’s been immense M&A, or they went public over that time period.

The first column compares R&D Expense CAGR divided by SG&A Expense CAGR which can be deceiving if for example with WISH, R&D spend was incredibly small in 2018 and 5x’d versus their SG&A spend that was already extremely high in 2018 and didn’t grow much.

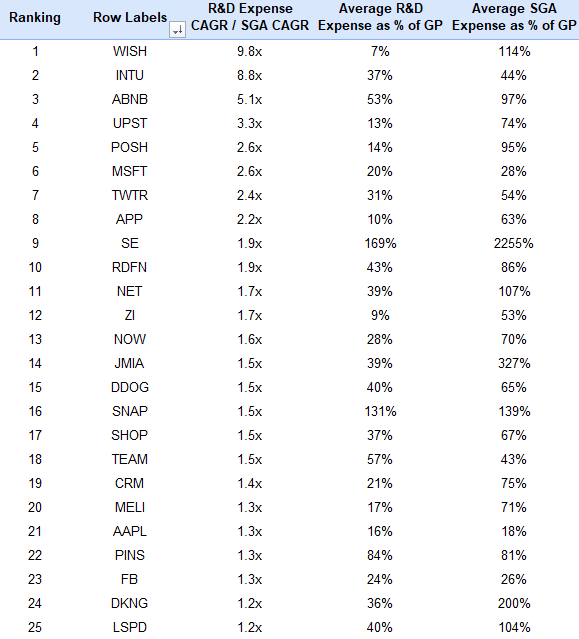

Now for the Top 25 sorted by highest R&D Expense CAGR / SG&A Expense CAGR:

Takeaway

To me, the most eye popping companies using this lens and a splash of context are Intuit, Airbnb, Microsoft, Twitter, Redfin, Datadog, Snap Inc, Shopify, Atlassian, Pinterest, Facebook and Lightspeed.

WISH is deceiving here but that’s why I included the two columns on the right!

Now the top 10 sorted by lowest R&D Expense CAGR / SG&A Expense CAGR:

Takeaway

Quite the interesting group of companies here where I wouldn’t expect Tesla to be leading the pack but that’s due to minimal growth in R&D spend over the last four years hovering around 1.4-1.5B.

I’d say if anything the most damning this is for any of these companies is either BigCommerce, Farfetch or Shift4.

A Mix of Everything

This is going to be some black magic to some but I think will give a great look on bringing all the parameters scattered throughout this newsletter in one final screen. The parameters I’ll use for this:

Remove law of small numbers (looking at you WISH)

R&D Expense CAGR outpaces both GP and SG&A CAGR

Growing R&D Expense as % of GP (aka > 0%)

2020 R&D Expense as % of GP above 30%

Total R&D Expense as % of GP over 2018-2020 over 25%

These parameters output 15 winners! Sorted by highest Total R&D Expense as % of GP from 2018-2020:

Takeaway

I’d say the ones that are really impressive from this group are the ones where total SG&A Expense isn’t larger than Gross Profit dollars created over 2018-2020.

Hard to look at this table and not be impressed with Pinterset, they got some stuff up their sleeve. Twilio and Datadog are probably the next two most impressive to me and I was surprised to see companies like Hubspot and Intuit make it through all these parameters.

Overall this seems like it netted an innovative bunch that is worth looking out for uncovering new revenue streams.

Conclusion

I really hope this wasn’t damn near impossible to understand. I know there’s a ton going on here and might require some background in statistics or finance but my goal was to best explain the why as much as I could.

My personal takeaways from this fun black magic exercise:

Pinterest is one to watch on the innovation front

Roblox & Snap Inc absolutely love spending money on R&D

Sea Limited and DraftKings may or may not be subsidizing their growth

Why do Palantir and Snowflake have such high SG&A expenses being B2B tech companies..?

Confirms my biases on Lightspeed being a juggernaut for the future of omnichannel commerce

Comment your takeaways below! I’m open to all feedback or editing in any further explanations where this is difficult to understand, no offense will be taken. I have no issue admitting I’m a terrible writer and my girlfriend proofreads these with little context to this all haha.

DM’s are always open on twitter as well! Always open to talk