Q3 2021: Lightspeed Commerce Deep Dive

The Jiggy Capital Newsletter #4

Link for viewing this newsletter in separate window

For my first deep dive newsletter, I’m going to be discussing Lightspeed Commerce, the Montreal-based one stop shop for all things commerce. This is a company I’m really excited about and - full disclaimer - is my largest position currently.

Doing these kinds of newsletters is slightly out of my comfort zone due to so much to cover and convey with “deep dives” and wanting to do the best job balancing word jumbles and non value added regurgitation of investor decks etc. Big reason why I’ve only decided to do one of these per quarter so I can make sure I do a decent job (hopefully).

The only way I’ll get better at these is by starting somewhere, compounding knows no bounds of application! I’m open to all feedback on the style and format of the deep dive. None of the opinions portrayed are intended as financial advice.

Now lets do this! This is a long read so feel free to skip around to different areas that interest you more than others, I won’t be offended.

Table of Contents

Lightspeed Overview

Top Level

Products

Target Verticals & Current Customers

Acquisitions

Management

Ownership

Financial & KPI Analyses

Fundamental Analysis

Forward Projections

Peer Multiple Comparison

Recent Quarterly Results & News

Bull Case

Bear Case

My Plan

Sources & Further Information

Lightspeed Overview

Top Level

Let’s start it off with Lightspeed’s mission statement from their S-1:

At Lightspeed, our mission is to bring cities and communities to life by powering small and medium-sized businesses (“SMBs”). We believe cities and communities are built on the presence and success of local SMBs and that these businesses are integral to the vibrancy of their communities. Running an independent business, however, is becoming increasingly complex. Consumer behaviors and expectations are changing, fueled by the influence of new technologies pushing consumers towards an omni-channel experience. Our solutions equip independent businesses with the technology required to transform the way they manage their operations and exceed consumers’ expectations in this changing environment.

Lightspeed Commerce, formerly known as Lightspeed POS, is a one-stop-shop for all things commerce in the retail, restaurant and golf spaces. Founded in 2005 by CEO Dax Dasilva in Montreal, Canada, Lightspeed started out as an iPad point-of-sales (POS) operating system (OS) that has evolved quite a bit since then into a cloud-based ecosystem.

Lightspeed Commerce is a dual listed company, where they first IPO’d on the Toronto Stock Exchange (TSX) at a $1.4B valuation raising $240M CAD or about $111M USD in May of 2019.

Lightspeed then IPO’d on the New York Stock Exchange at a $5.9B valuations raising $332M in gross proceeds in September of 2020. For the NYSE IPO, underwriters included Morgan Stanley, Barclays & BMO as joint lead book-running manager, while BofA and RBC were joint-bookrunners, and CIBC, KeyBanc, Raymond James, Scotiabank, TD and Truist were co-managers.

Here is a chart showing Lightspeeds change in market cap since August 2019, where it now sits at 18.7B (sitting at a fresh all time high) while reaching a low of 1.1B at the pandemic bottom in March 2020:

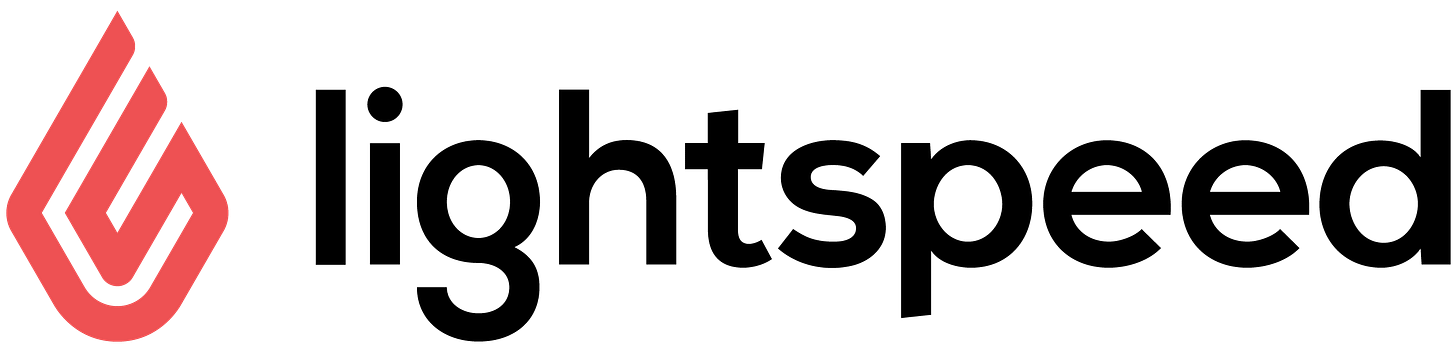

Lightspeed now offers all that’s shown below dealing with the front and backend of company operations ranging from supplier networks, eCommerce platforms, payment processing and even capital lending.

Lightspeed is right in the middle of the covid accelerated trend of omni-channel commerce, which basically means a software solution supporting different buying channels such as Brick-and-Mortar, Online, Curbside Pickup & Delivery, Order Ahead, Mobile Apps or even open source APIs. This was something that wasn’t necessarily needed for most retail SMBs, boutique shops or fancy restaurants, but since the pandemic this has changed. CEO Dax Dasilva likes to say about omni-channel commerce “it went from nice to have, to must have”.

Products

As shown above, you could break Lightspeed’s product offerings into three main buckets:

Back-Office Suite

Omni-Channel Reach

Payments & Financing

Back-Office Suite

To begin with the back-office suite, this is one that has seen the most progression over the years, mostly from acquiring different companies and bundling their best tech together while still letting some of them operate as standalone businesses still like Upserve, NuOrder & Shopkeep for examples.

This strategy will culminate together when Lightspeed launchers their K-Series by the end of Summer in USA. Some color from Lightspeed’s recent earnings call on this:

As you know, we’ve been working toward the launch of our product in the U.S. that’s going to be called K Series, which is our flagship. And really, that product is going to be a combination of Lightspeed Payments, the K Series POS, the ingredient management, and the advanced analytics platform, and that is due to be launched by the end of the summer in the U.S. We believe that’s going to be an extremely competitive product for the market.

We have, today, Upserve and Lightspeed that serve that market, but we’re very bullish and excited about this launch. We feel that the combination of everything that we’re putting together is going to be very unique in the market.

There’s a lot of current restauranteurs who are opening new facilities. So we feel the market is up for grabs right now. And let’s now forget that the majority of this market is on legacy systems still. And there’s a big opportunity here for — to go and grab it.

Hard to not get excited by that color in my view. I would imagine we see something similar like this for retail as well in the future and these offering rolled out to global Lightspeed customers.

One last part I’d like to include is how well thought of Upserve and Lightspeed are for Restaurant POS solutions as is. A great video by Youtube channel “Dave Allred TheRealBarman” I watched during my beginning research highlighted Upserve being a leader the best overall POS system out there, with Lightspeed’s own branded offering at fourth best, sandwiched between Toast and Rezku at three and four and Thrive at five.

Linked in the “Further Readings” section is another video where the YouTube channel StoreKit titled “The 5 Best Retail POS Systems in 2020-2021” where Lightspeed owned Vend comes in at second, and Lightspeed comes in at fourth.

Both of these videos give great top level highlights on why Lightspeed’s offering is so competitive compared to others and both are highly recommended watches.

Omni-Channel Reach

Omni-channel Reach offerings is pretty self explanatory from previous description in the top level section. This is something that will only evolve as the pandemic brought increased need for these kinds of channels, especially ones like order ahead and curbside pickup.

Lightspeed Capital

Finally, the Payments & Financing bring some of the most exciting new avenues for Lightspeed as both are still in their infancy. Lightspeed payments, launched in late 2019, brings an incredible opportunity for future growth when you consider the unit economics.

In non-Lightspeed Payments users, Lightspeed takes a bottom line 0.25% of GTV through referral programs. With Lightspeed Payments, they now take a bottom line 0.65% of GTV, almost triple the current bottom line take rate! Throw in that only 10% of current customers use Lightspeed Payments, there is tons of runway here. In their latest earnings call, management boasted a payments attach rate of new customers “going up and up” and see a long term goal of 50% of Lightspeed customers using their payments network as they continue to expand the offering to their other regions.

With Lightspeed Capital, this was launched in August 2020 to US-based retailers using Lightspeed Payments, in partnership with Stripe. These loans started at $50,000 per retail location with the potential to expand as time went on. Companies like Lightspeed doing these loans only makes sense when you consider how much data these companies have on their customers with different insights than a traditional bank would have giving that financing. The best part about this Stripe partnership is that it leverages their capacity for capital, meaning that Lightspeed doesn’t carry those loans on their balance sheet.

What’s really exciting, and a theme throughout this deep dive, is that a very strategic acquisition opened up new, more profitable option for Lightspeed. In this case, when Lightspeed acquired ShopKeep, they also inherited their ShopKeep Capital business which does these in house loans at a much more profitable clip.

Here is some color from CEO Dax Dasilva on this:

Lightspeed Capital had its best quarter by far and we are starting to see numbers that are more meaningful. Almost 430 capital advances were made in the quarter with revenue from capital growing 68% from the previous quarter.

We continue to maintain two offerings here. Lightspeed Capital, where we leverage our payments partner, Stripe, and the ShopKeep Capital business, which we inherited when we acquired ShopKeep. This quarter, we are expanding the ShopKeep Capital model to Upserve customers and have already seen some initial success there. For now, this remains a small, but highly profitable business for us, with revenues still under $1M quarterly.

This is just another example of a beginning-stage, highly profitable revenue stream just like Lightspeed Payments, with tons of runway.

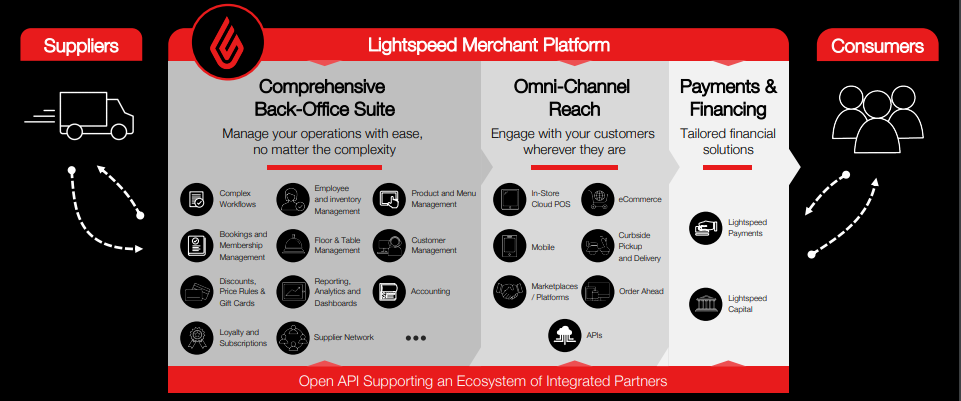

A final look at how theses product offerings have expanded since Lightspeed was created in 2005:

The last nugget shown here is the Google Local Ads partnership, which was announced in May of this year to help retailers increase local shopping revenue which will allow integration with omni-channel retailers to automate ads and real-time inventory levels directly from the Lightspeed platform.

Lightspeed customers will now be able to manage a professional Google My Business listing straight from Lightspeed’s commerce platform, keeping customers up to date with the latest information regarding things like store hours or COVID-19 safety protocols in place.

A case study in the above linked release highlighted a dive shop that saw a 54% increase in revenue after one month using this integration!

Target Verticals & Current Customers

Target Verticals

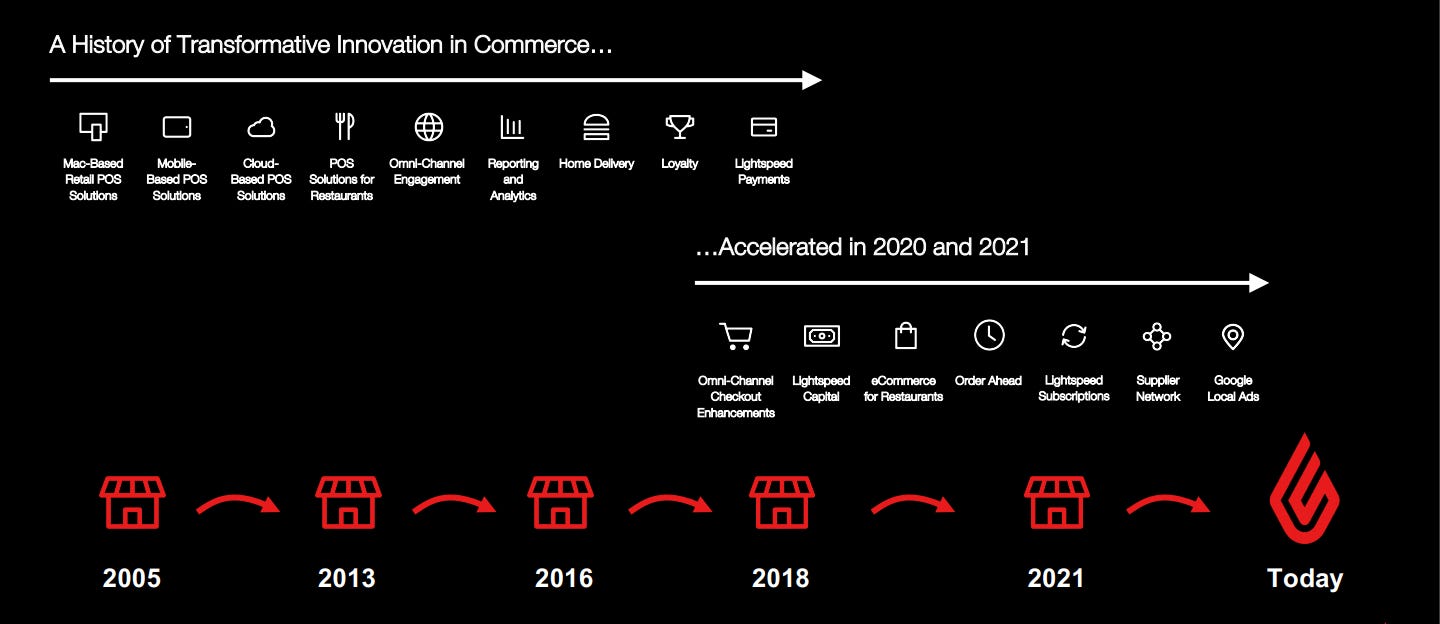

Lightspeed positions itself as a cloud-based solution for complex workflows with extensive inventory, and breakout their target solutions into three main groups: Retail, Restaurant & Golf (I mean cmon, as a huge golf fan its pretty cool to see that as a standalone section).

What makes Lightspeed much different than most other companies in this space is they’re also very specific in the subcategory verticals they target ranging from Bikes, Electronics, Liquor, Sporting Goods, Vape, Bars, Cafe, and all kinds of Golf course types. Lightspeed is not trying to be everything for everyone like other loose, more broadly known competitors like Square and Shopify.

I believe perfecting and dominating specific verticals is a powerful strategy, and Lightspeed management agrees when they were asked about Shopify specifically in the most recent earnings call:

Q: Obviously, Shopify is saying they’re seeing an acceleration of their point-of-sale system. Just wondering whether you’re seeing them more now in the marketplace than before?

A: So our close rates are just as strong as they’ve ever been within the markets we serve. And again, our view is we’re not trying to be everything to everyone. What we want to do is we want to be strong within the segments that we serve, which are merchants that have kind of heavy inventory lifting. And in that market, I think we’re stronger than ever, and we’re not feeling any kind of threats from other companies

Another wrinkle that makes Lightspeed a fun company is that they’re in 100+ countries giving exposure to the world economy of retail and eCommerce tailwinds moving towards this omni-channel commerce model.

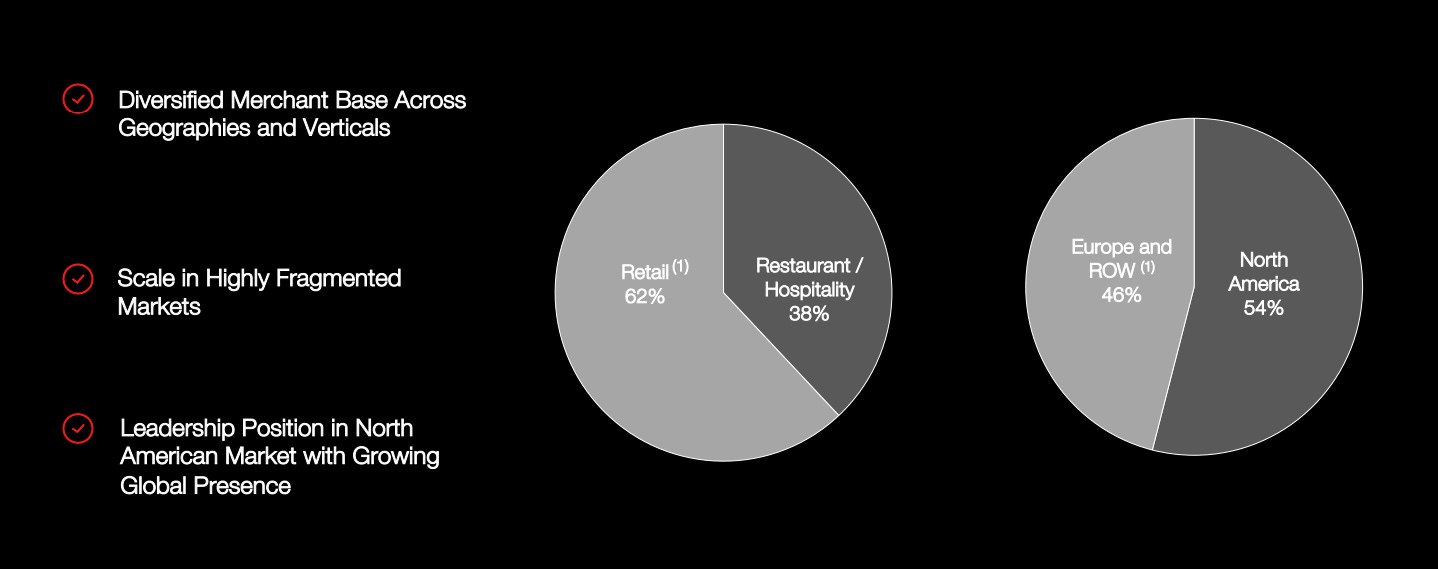

Lightspeed currently sees a balanced customer breakdown by region and industry, shown below:

Current Customers

I think the best way I can grab reader’s attention with Lightspeeds current customers is they announced that SpaceX HQ became a customer this past quarter for Lightspeed’s Retail, Payments and Restaurant solutions.

Other highlighted retail/restaurant customers: FC Cincinnati, AG Jeans, Banff Sunshine Village, Lan Kwai Fong Group all being Lightspeed Payments customers along with retail and restaurant solution providers. Even Jim Cramer’s diner in Long Island is a UpServe customer!

The really fun part for myself was digging into Lightspeed’s golf customers which truly blows my mind. Let’s take a look at the Golf Digest America’s 100 Greatest Golf Courses list to see how many Lightspeed Golf does:

Sand Hills Golf Club - 10th Overall

Bandon Dunes - Pacific Dunes - 18th Overall

Los Angeles Country Club - 19th Overall

Oak Hill Country Club - 20th Overall

Southern Hills Country Club - 32nd Overall

Bandon Dunes - 37th Overall

Erin Hills - 46th Overall

Bandon Dunes - Old Macdonald - 56th Overall

Bandon Dunes - Bandon Trails - 67th Overall

Now, for some more fun lets look at Lightspeed Golf customers who either have hosted a Major Championship or a PGA Tour event:

Oak Hill Country Club - Home of the 2013 PGA Championship won by Jason Dufner

Chambers Bay - Home of the 2015 US Open won by Jordan Speith (infamous DJ 3-putt choke)

Erin Hills - Home of the 2017 US Open won by Brooks Koepka

Bellerive Country Club - Home of the 2018 PGA Championship won by Brooks Koepka

Harding Park - Home of the 2020 PGA Championship won by Colin Morikowa

Torrey Pines - Home of the 2021 US Open won by Jon Rahm and many many more previous majors

Los Angeles Country Club - Home of the 2023 US Open

Southern Hills Country Club - Home of 3 US Opens, 4 PGA Championships, most recently in 2007 won by Tiger Woods and will also host the 2022 PGA Championship

Kapalua Bay Course - Home of the PGA Tour Sentry Tournament of Champions event

TPC Scottsdale - Home of the PGA Tour Waste Management Phoenix Open event

Caves Valley - Home of the PGA Tour 2021 BMW Championship, going on this weekend!

East Lake Country Club - Home of the PGA Tour Playoffs Finale Tour Championship event (next weekend)

Firestone Country Club - Previous home to the WGC-Bridgestone Invitational

I mean how fun are those two lists…I get to own a company that boasts TWO Brooks Koepka and Tiger Woods major venues as Lightspeed Golf customers? Yeah, that’s fine by me.

Most of these premium customers come by way of Lightspeed Golf’s deals with Kemper Sports and the third-party course management company Landscape Golf Management, which were both huge wins for the Lightspeed Golf business.

Acquisitions

As you can tell, Lightspeed has held both an organic and strategic M&A for their growth roadmap. In this section I’ll quickly highlight the main acquisitions they’ve done since 2015, and as you’ll see each one of these unlocks something Lightspeed didn’t have previously whether its by new region or product offerings.

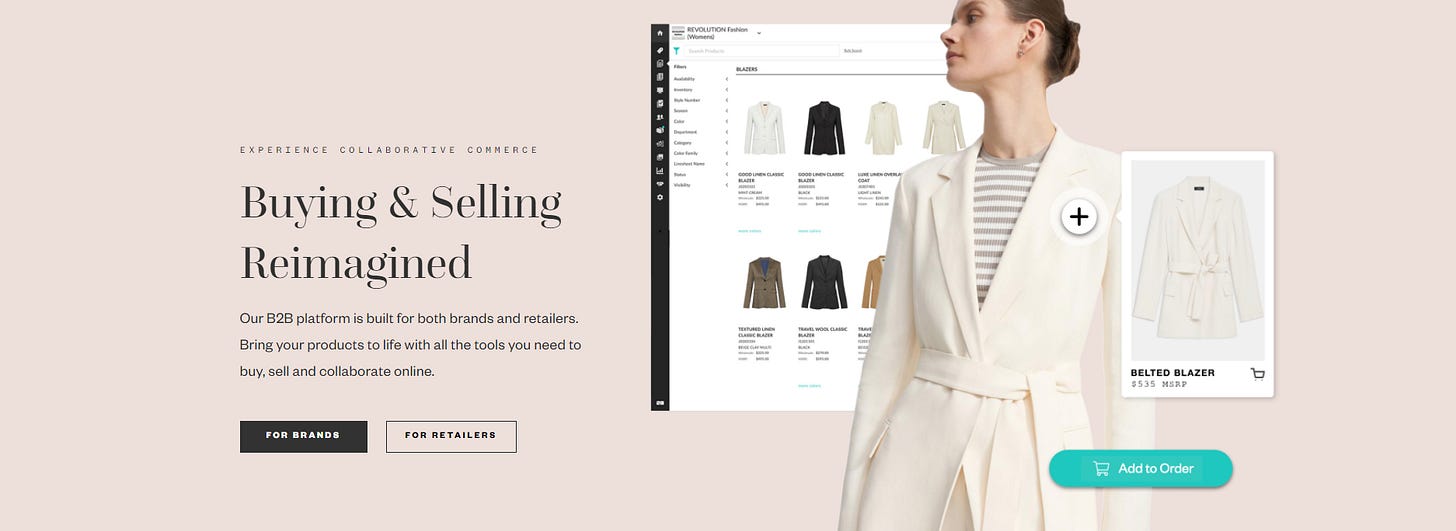

NuOrder - Release

NuOrder, a B2B eCommerce platform, is the most recent acquisition to close in July 2021. This deal was done with $209M in cash, and 2.1M in shares. What this acquisition does is accelerates Lightspeed’s Supplier Network offering a great deal first and foremost.

NuOrder is basically an eCommerce platform for retail shops to stock from, and boasts 130,000+ paying customers with 3,000+ active brands such as Canada Goose, Converse & Arc’teryx.

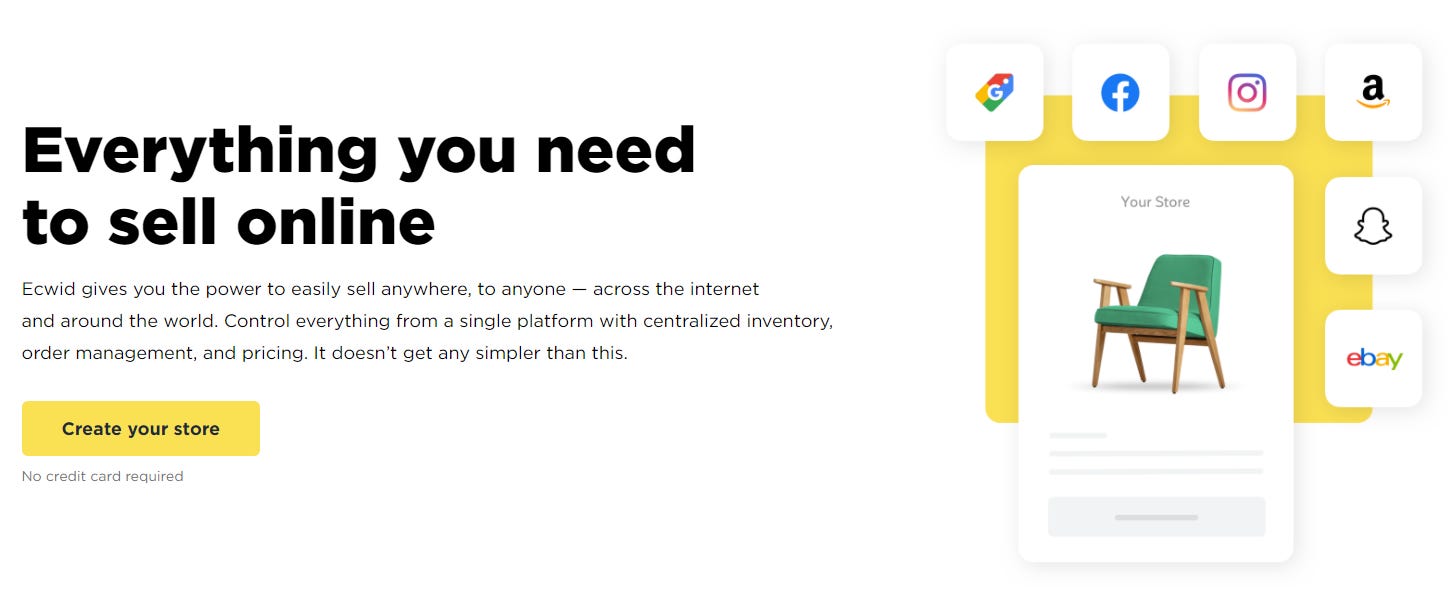

Ecwid - Release

While this acquisition still hasn’t closed and is expected to by the end of September 2021, Ecwid brings a new presence of eCommerce to Lightspeed merchants. Ecwid is an interesting widget platform for SMBs (name is shortened for e-commerce + widgets), with easy-to-use tools that can integrate in a number of new channels like Facebook, Snapchat, Instagram, Pinterest, Amazon, and more

Ecwid boasts 130,000+ paying customers spanning 100+ countries. This deal was $500M in total value, broken down by 35% cash and 65% equity.

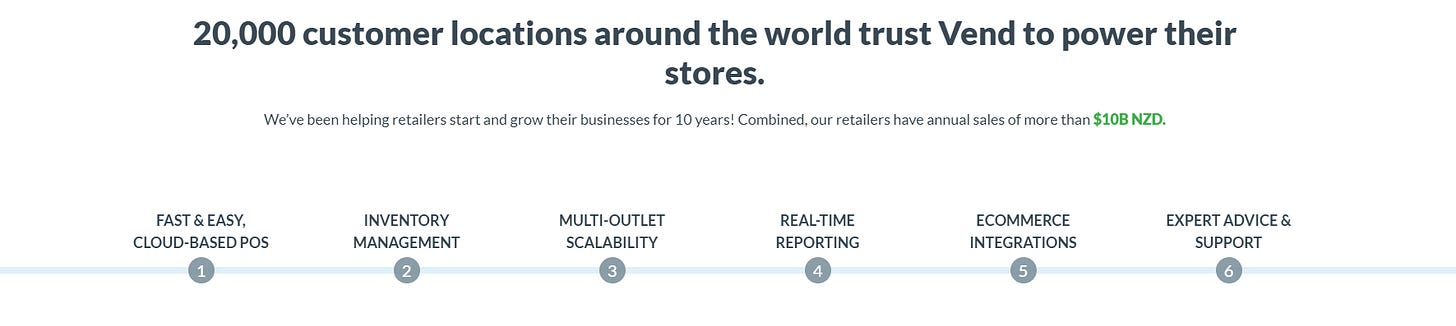

Vend - Release

Vend, whose acquisition closed in April 2021 for $205M in cash and 2.7M shares, brings a cloud-based platform for multi-location retailers to view their stores across one platform. Vend boasts $7B in 2020 GTV, 20,000+ customer locations, and Lightspeed will gain significant retail presence in APAC & EMEA to compliment existing hospitality market share.

ShopKeep - Release

ShopKeep acquisition closed in December 2020 for $440M total between Cash and Equity (not specified). ShopKeep is a U.S. based cloud-based commerce platform in retail and hospitality that greatly boosted Lightspeeds market presence in the USA.

As mentioned before, this unlocked an inhouse ShopKeep Capital business that is much more profitable than the existing Lightspeed Capital partnership with Stripe. ShopKeep boasts another $7B in 2020 GTV and 20,000+ customer locations.

Upserve - Release

Upserve acquisition also closed in December 2020, for $99M in cash and 5.9M shares. As highlighted earlier, Upserve is a leading U.S. cloud-based restaurant management platform with extensive analytics.

Upserve boasts $6B in 2020 GTV across 7,000+ locations (Toast is at 48,000 customer locations for reference). Lightspeed highlights this acquisition greatly enhances their analytics, inventory management, and workforce management capabilities across different sectors and verticals.

Gastrofix - Release

This Gastrofix acquisition closed in January 2020, and was another region strategic purchase for the cloud-based hospitality POS solutions provider. Lightspeed mentions that Gastrofix’s 8,000+ customers across Europe solidifies their footprint across Europe.

Chronogolf - Release

For the rest of these acquisitions, I have much less data on them since these were before Lightspeed was public. The cloud based pro-shop and snack-shop management platform, Chronogolf acquisition closed in May 2019 where it gave Lightspeed instant leadership into the golf vertical.

Chronogolf, at the time of deal close, is home to 700+ golf courses worldwide, where growth in new customers was >100% for the last six months of 2019. They do everything from tee sheets, remote management access, online bookings, pro-shop management & even snack-shop management technologies.

Ikentoo - Release

The Ikentoo acquisition closed in July 2019, where it was a region strategic purchase for the cloud-based POS solutions and business management systems for restaurant and hospitality. Ikentoo serves 4,000+ customers primarily in Europe and Africa, with the strongest presence in Switzerland, France & South Africa.

Kounta - Release

The Kounta acquisition closed in October 2019, where the Australian cloud-based POS hospitality solution platform for SMBs strengthened Lightspeed’s footprint in the APAC region.

ReUp - Release

The ReUp acquisition closed December 2018, was an acquire-and-rebrand purchase for the customer loyalty program software, which is now known as Lightspeed Loyalty.

SEOshop - Release

Finally, the SEOshop acquisition closed in November 2015 where it was another acquire-and-rebrand purchase for the eCommerce website creator company. This helped Lightspeed launch their eCommerce offering.

Honestly, the above sections felt like a deep dive in and of itself, so if you’re still interested at this point, we will be diving deeper on what drives Lightspeed!

Management

Executive Management

As previously mentioned, Lightspeed checks off a major box being still being founder-led over 16 years later by CEO Dax Dasilva, who is still only in his young 40s. Dasilva is a Computer Science major, who boasts accolades such as the Ernst & Young Entrepreneur of the Year award in 2012, Startup Canada’s Entrepreneur of the Year Award in 2016, and was name one of the 100 Most Intriguing Entrepreneurs by Goldman Sachs in 2017.

Dasilva joins others like Tim Cook in a small handful of openly gay CEO’s of publicly listed companies. Dasilva and Lightspeed are both very LGBT+ progressive where the first four employees were also members of the LGBT+ community.

Others on the executive management team include:

President Jean Paul Chauvet - Joining in 2016 after holding various leadership positions at Atex Group across Europe and Asia

CFO Brandon Nussey - Joining in 2018 after serving as CFO at D2L Inc., a SaaS-based education technology provider from 2010-2018

EVP, Marketing Lory Ajamian - Joining in 2012 and working her way up from starting off as Office Cordinator! Inspiring journey for Lory.

CBO Michael DeSimone - Previous CEO of ShopKeep, joining the Lightspeed team in 2020. Prior to ShopKeep, DeSimone was the President and CEO of Borderfree and lead them through a successful 2014 IPO and subsequent sale to Pitney Bowes in 2015. Also earned recognition on the Smart CEO’s Future 50 List in 2015

General Manger, Retail Ana Wright - Previous CEO of Vend, joining the Lightspeed team in 2021. Previous experience spans roles as SVP at McKinsey & Company, Microsoft, and Spark.

General Manager, Hospitality Peter Dougherty - Been with the company for almost 10 years starting off as a Junior Sales Representative! Another inspiring Lightspeed success story as he’s still quite young.

CRO & CCO Jean-David Saint Martin - Former CEO and co-founder of Lightspeed acquired Chronogolf

If nothing else, it’s extremely pleasing to me so many of the acquired companies’ CEOs are on the executive team! All are quite young as well. Full page on each executive.

Board of Directors

Chair of the Board Patrick Pichette - Extremely impressive background, Pichette served as Google SVP and CFO from 2008-2015. Pichette currently hold the role of General Partner at Inovia Capital, a Canadian venture capital firm, as well as serves as Independent Board Chair of Twitter(!)

President & Director Jean Paul Chauvet

CEO & Director Dax Dasilva

Director Marie-Josee Lamothe - Lamothe joined the Lightspeed board after previously served as Managing Director of Consumer Products, Government and Entertainment at Google Canada

Director Merline Saintil - Previous COO of Change Healthcare and Head of Operations, Product & Technology with Intuit Inc. Saintil also held leadership positions at Yahoo, Joynet, PayPal and Sun Microsystems

Director Rob Williams - Holds over 20 years of expereince in eCommerce and Retail, coming most recently from Amazon where he led Tier 1 Vendor relationships globally spending over a decade with the company.

Director Paul McFeeters - Formerly the CFO of OpenText while also previously serving on the boards of Hootsuite, Constellation Software and Blueprint Software Systems

Talk about an all-star Board of Directors! Easy to see how Google and Lightspeed have such a good relationship when you take a look here. Full page on each Director

Ownership

From the Lightspeed S-1, this is slightly confusing for my non-finance background mind to understand, but I’ll gladly share it still:

As seen, the second largest pension fund in Canada, Caisse de dépôt et placement du Québec, holds the largest amount of Lightspeed at 17%. Dax Dasilva also holds, from my basic knowledge dividing that 14.6M shares by 146M total outstanding shares, roughly ~10% of the company shares which I love to see.

Other Executives holding large stakes are President Jean Paul Chauvet, EVP & General Counsil Daniel Micak, and EVP of Finance Asha Bakshani.

Institutional and Hedge Funds

Here, it’s confirmed CEO Dax Dasilva owns 10.24% of Lightspeed, with others like Vangaurd, Blackrock, Capital World Investors, Echo Street, Wells Fargo, Vista Equity Partners and others owning ~1%. The largest Institutional sellers of Lightspeed in the most recent 13-F’s reported earlier this month are Canaan Partners, Citadel, Morgan Stanley, and Bain Capital.

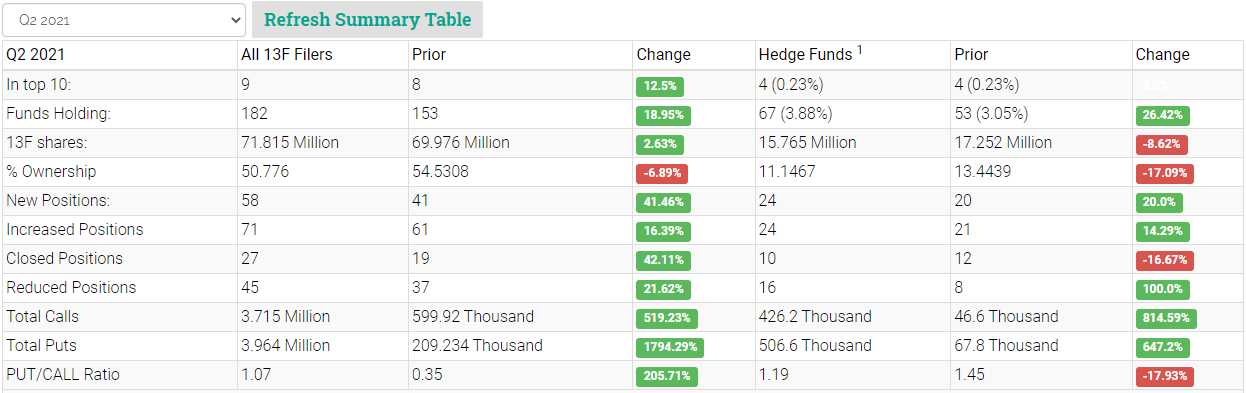

Now looking at general fund movement trends from this past Q2 filings

Most of the fund trends were positive with a 19% increase in total funds, but a lowered Institutional % ownership at 50.7%, down from 54.5% last quarter. A much higher flow of Total Calls and Puts is quite evident while the P/C Ratio went from 0.35 to 1.07.

Total Hedge Funds also increased 26% to 67 total from 53 last filings. With the Hedge Funds we actually saw a decrease in the P/C Ratio, while total calls and puts held basically 10x’d.

Financial & KPI Analyses

In this section, we will be looking at Lightspeed’s Income Statement, analyzing their Financials and KPI’s (Key Performance Indicators) that we have broken out.

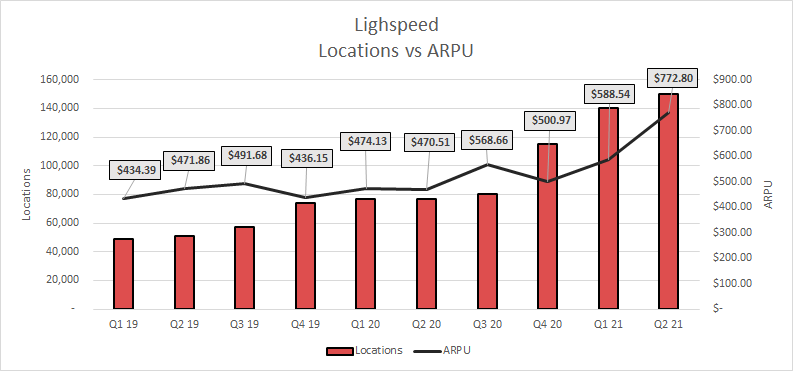

Let’s start with a chart of the leading indicator of future revenues, Customer Locations, versus ARPU (Average Revenue per User):

The last three quarters, Lightspeed has seen an impressive uptick in ARPU and Customer Locations. Customer locations have grown as an impressive 3-Year CAGR of 43% and an even more impressive QoQ CAGR of 12%.

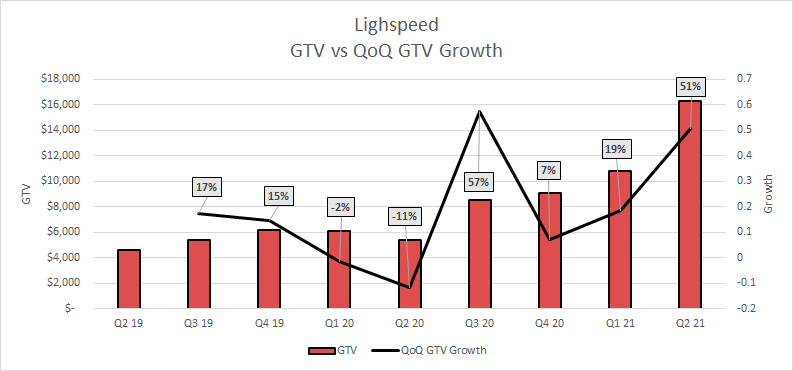

Now let’s take a look at GTV vs QoQ GTV growth, since this is indicative of a long runway for higher take rates in Lightspeed Payments. In my view it’s fair game to judge these companies by QoQ instead of YoY since they’re in such a deep growth phase that seasonality is pretty hard to spot.

This is the kind of GTV trend you’d like to see for Lightspeed imo. After making a COVID related rebound in CY Q3 20 to a new ATH of GTV, they’ve accelerated that GTV growth over the last three quarters. 51% QoQ growth this past quarter blows my mind even though at least 25-40% of that total is inorganic from acquisitions.

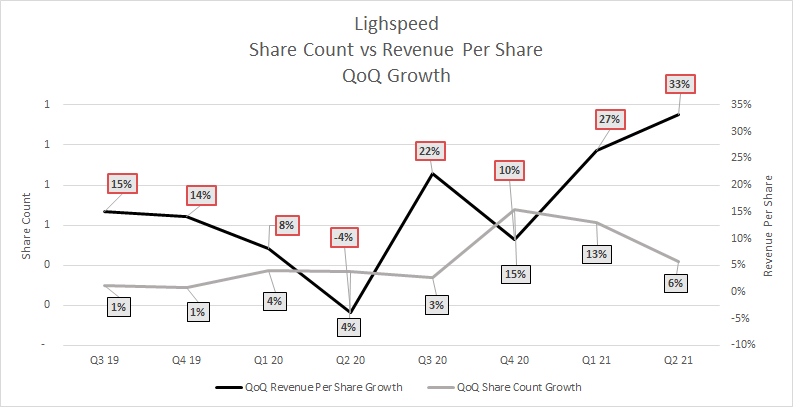

One of the biggest question marks with Lightspeed is their dilution of shareholders for these (objectively good) acquisitions. Here we will be comparing Lightspeed’s Share Count QoQ growth vs Revenue Per Share QoQ Growth to see who outpaces who.

The good news, Lightspeed Rev Per Share growth has greatly outpaced Share Count growth luckily. Over the past nine quarters, Rev Per Share CAGR was 13% whereas Share Count CAGR was 5%. Still something to watch no doubt.

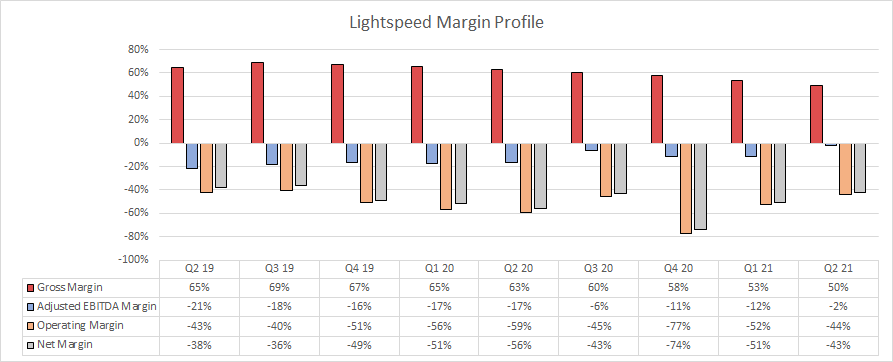

Taking a look at Lightspeed’s margin profile and how that’s differed as they’ve grown:

Gross margins have dropped from 65% in Q2 19 to 50% in Q2 21 but that is easily attributable to Lightspeed Payments becoming 50% of their revenue in short notice. Adjusted EBITDA margins are on the verge of flipping positive which is what you’d like to see at the least, while Operating and Net Margins have stayed stagnant in the -40% range. I’m fine with this as there is such an expanding TAM Lightspeed is fighting for and are continuing to re-invest in the business (which I’ll get to).

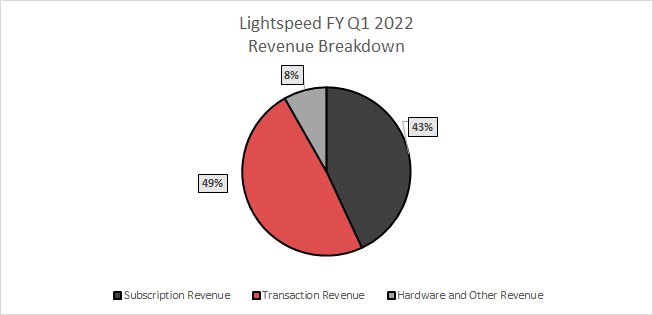

Since I mentioned that Lightspeed Payments revenue was about 50% of their total revenue this past quarter, let’s take a look at the revenue stream breakdown since this is the first time Lightspeed has broken it down into three categories:

Subscription Revenue - recurring

Transaction Revenue - recurring in nature

Hardware and Other Revenue - non-recurring but leading indicator for future growth in other segments

And there you have it, Lightspeed Payments is 49% of Lightspeeds most recent quarterly revenue with only 10% of total Lightspeed customers using their Payments offering. This will only continue to skew that way imo and in turn pushing gross margins down, but don’t misunderstand this is a fantastic development in my eyes!

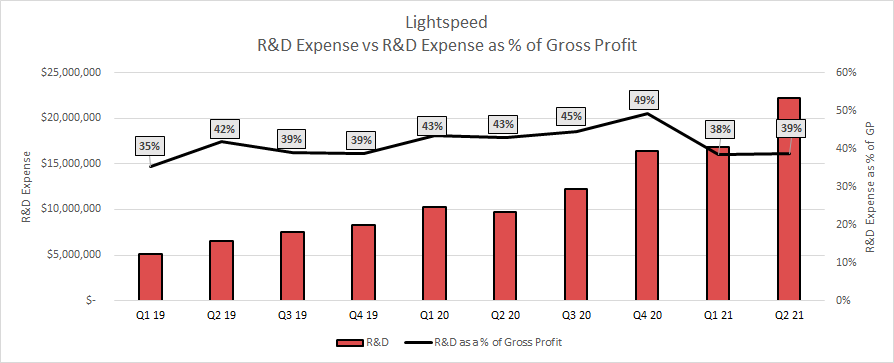

Finally, let’s look at something that was actually one of the reasons that really caught me eye for this being a potential special company, and that is their R&D spend! Here we will look at total R&D Spend vs R&D Spend as a % of Gross Profits (to negate change in margins from payments):

This is probably my favorite chart I’ve shared so far in this section. Even as Lightspeed’s revenue has grown triple digits YoY, their R&D expense has absolutely kept up with that increase growing every single quarter except for the peak of the pandemic where there was no given we would see the V-shaped recovery we did.

For a company targeting such a large TAM, opportunity, and growing rapidly, this is exactly what you’d like to see!

Fundamental Analysis

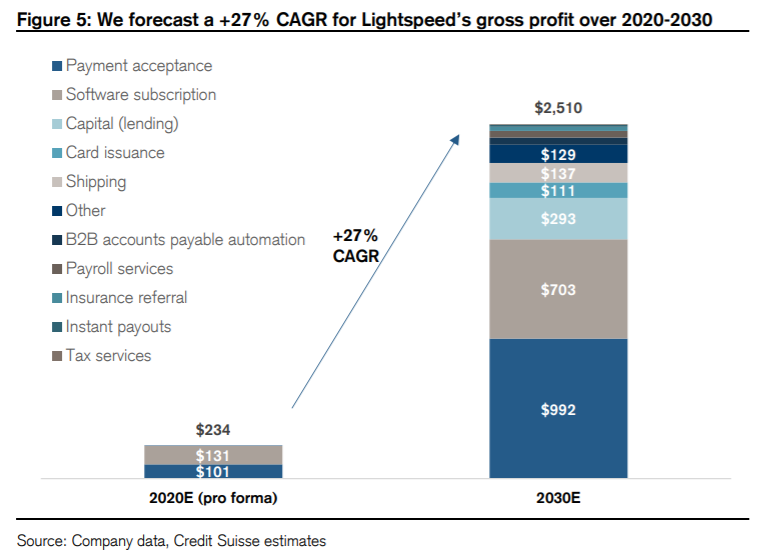

For this section, we will be taking a look at Lightspeed’s forward growth projections as well as their multiples compared to other peers in the payments and fintech space.

Forward Estimates

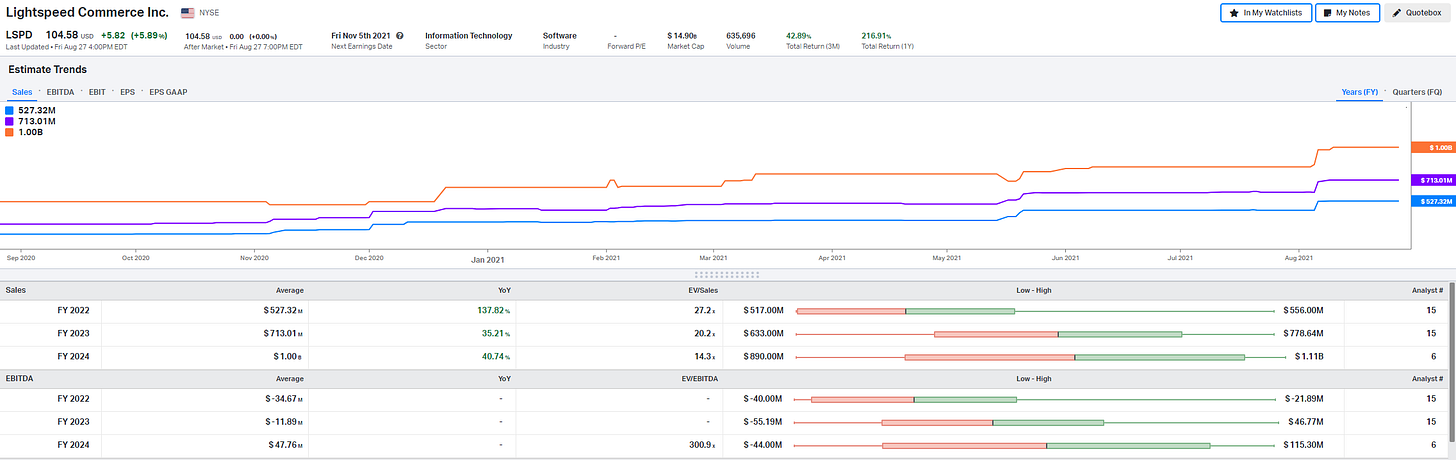

First, let’s look at their forward estimates and trends, as the trend of analyst projection revisions is a key indicator of a company that will continue to outperform expectations (simple concept I know).

Please note the Koyfin data for Market Cap is without the recent offering, where Lightspeeds market cap is actually 18.8B currently:

As seen above, Lightspeed analyst projections have wildly changed since their NYSE IPO last fall, and even more drastically after this most recent quarter. Beginning revenue projections for the FY 2022 started at $233M, where the estimates are now at $527M which represents almost 100% growth in upside from just the closest fiscal year projections!

Also worth noting that Lightspeed is projected to become EBITDA positive by FY 2024, but are projected to be right on the cusp of that inflection for the next two fiscal years.

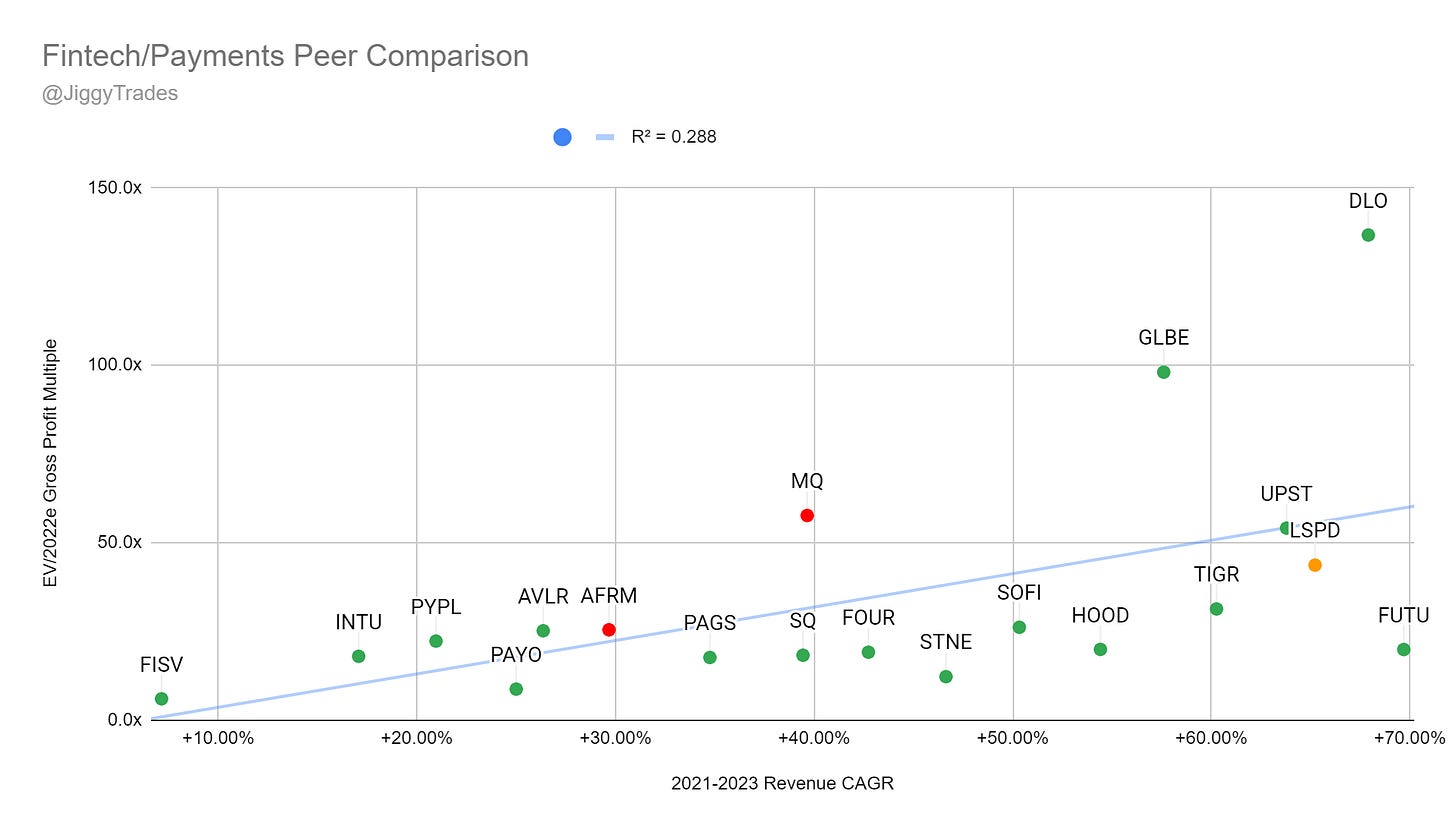

Peer Multiple Comparison

For this next section, I’ll be using a scatter plot showing three different items:

2021-2023e Revenue CAGR Projections on X-axis

EV/2022e Gross Profit Multiple on Y-Axis

Color coding if a company is EBITDA positive (green), projected to be in next three years (orange), or not projected to be in next three years (red)

As seen above, Lightspeed is in the upper quartile of next three years revenue CAGR at 65%, and just barely below the trend line for what you’d expect a companies multiple to be in this segment based off their growth projections. Interestingly enough they are the only one in this group that is projecting EBITDA positive over next three years, but not there yet (I would imagine they could be if they wanted to today).

Recent Quarterly Results & News

Recent Quarterly Results

Lightspeed’s most recent earnings report for Fiscal Year 2021 Q1 was quite the impressive showcase of company execution. Top level highlights include:

Revenue of $115.92M (+220% YoY), beat street estimates by +25%

EPS of -$0.05, beat street estimates by $0.04

Transaction-based revenue of $56.5M, up 453% YoY (my biggest KPI)

GTV of $16.3B, up 203% YoY

Now this does include inorganic revenue growth, as the note the recent acquisitions of ShopKeep, Upserve and Vend added $50.5M in revenue, but when you realize that’s still only about 44% of this quarters revenue, it’s still quite impressive.

The full earnings release is found here.

Recent News

(8/11/21) Lightspeed Announces Closing of US$716.1 Million Public Offering at $93.00 per share - Full Release

(8/4/21) Lightspeed Payments deploys to hospitality merchants across five European markets in Germany, Switzerland, France, Belgium and the Netherlands - Full Release

(7/2/21) Lightspeed Announces Closing of Acquisition of NuORDER - Full Release

(5/11/21) Lightspeed teams up with Google to help retailers increase local shopping revenue - Full Release

(5/4/21) Lightspeed partners with U.S. Small Business Administration to expedite hospitality industry relief - Full Release

(4/6/21) Lightspeed launches Lightspeed Payments in United Kingdom and Europe in expansion of tailored financial solutions - Full Release

(2/12/21) Lightspeed Announces Closing of US$676.2 Million Public Offering Including Full Exercise of the Over-Allotment Option at $70.00 per share - Full Release

(1/12/21) Lightspeed Revolutionizes Supply Chain of Independent Retailers with Launch of Supplier Network - Full Release

Bull Case

Lightspeed ecosystem offerings bring a rare moat in a commoditized product (POS solutions) with their high switching costs if one were to seek these services separately, bringing a long road of ARPU expansion

Lightspeed customers continue to buy new modules for locations and cross sell new offerings

ShopKeep Capital replaces their existing Lightspeed Capital partnership with Stripe which is much more profitable in-house

Lightspeed continues to convert legacy system users over to their cloud-based offerings

Lightspeed Payments continues to see positive traction and build upon their current 10% Lightspeed customers penetration as they continue to expand regional offering

Lightspeed K-Series offerings for U.S. Restaurants is a large success, and they roll it out globally

Lightspeed creates a similar bundling of all their best tech like K-Series for the retail space and roll that out globally

Lightspeed’s significant R&D investments are successful in creating new revenue streams

Lightspeed is founder lead for over 15 years, where the CEO has a 10%+ stake in the company

Bear Case

Lightspeed never grows into their lofty valuation

Execution risks of creating the synergies across acquired companies

Lightspeed fails to gain market share from fierce competition

Lightspeed projected margins decrease needing to stay competitive (commoditized product in POS solutions)

Lightspeed dilutes shareholders further negating company progress for equity holders.

My Plan

All in all, I hope you can understand why I’ve made this my largest position over the last couple months. Listing out the bull and bear case, I’ll take the upside vs downside risk of that any day as we’ve already seen Lightspeed management is executing at an extremely high level.

There is no doubt this stock isn’t cheap, and I think that’s for very good reason when you think about how many years of future growth Lightspeed has ahead for new revenue streams in their infancy, while attacking the incredibly large TAM for Global Retail, Restaurant, & Hospitality spaces.

My first buy of Lightspeed was at ~$82.00 in early July 2021 after watching Dax Dasilva go on Mad Money (funny right), my lowest buy was ~$78.00 shortly after but my cost basis is now at ~$89.50. This company is ripping new ATHs making a new one three times this past week.

I plan on buying much more equity in this company in a DCA fashion from this point onwards, as I’m really not sure there’s many more exciting companies on the public markets attacking such a large TAM while still in their early stage. This will be a staple of my portfolio for many years to come and wouldn’t be surprised if it stays my largest position for that time as well!

Dax Dasilva is exactly the type of CEO/Founder I want heading the ship of a company like this, and it helps me sleep quite well at night he owns 10%+ of the company so the stakes are quite high for him as well! I accept the volatility this name will see on broad market pullbacks and welcome it with open arms :)

Further Information & Sources

Sources

Further Information

YouTube Product Reviews

The 5 Best Retail POS Systems in 2020-2021 - Vend no. 2, Lightspeed no. 4,

The Top 5 Restaurant POS Systems of 2021 - Upserve no. 1, Lightspeed no. 3

Management Interviews

CEO Dax Dasilva BMO 2021 Tech Conference Interview - 45 min, highly recommended watch

CEO Dax Dasilva BBN Bloomberg Interview - May 2021

CEO Dax Dasilva Mad Money Interview - July 2021

CEO Dax Dasilva CNBC Closing Bell Interview - August 2021

Quality Articles/Threads

Twitter Thread by @GetBenchmarkCo - October 2020

Sorry if there are any substacks articles out there on Lightspeed, I couldn’t personally find any!

Closing

I had quite a bit of fun putting this deep dive together, and the best part of doing these write-ups is it forces you to strengthen your thesis and end up learning more about the company than before!

Although the goal for me in this deep dive was for a reader to make their way through this and have a good grip on all things Lightspeed Commerce, this should only be one part of your investment journey for any decision you make on the company!

If you’re familiar with any of Lightspeeds products, I’d love to connect and hear more about it! My Twitter DM’s are always open @JiggyCaptial

- Sean

Hey Jiggy. Awesome name! Awesome write-up! I think there is a mistake in your adj ebitda margin calcs for 2Q20 and 2Q21, but man, this is some top notch stuff. I look forward to reading your work in the future. Thanks for sharing!

How do you feel about the comments from Ben Axler yesterday?