Q4 2023: Year End Portfolio Update

The Jiggy Capital Newsletter #20

Here we are again!

With this being only my second post of 2023, I am hopefully calling the bottom in that frequency moving forward. After unfortunately not getting my year in review done last year for 2022 in time for it to make sense, I wanted to make getting the 2023 version out a top priority!

Table of contents for today’s post, which is a bit shorter than normal since I decided not to individually talk through each of my 20 positions:

Performance

General Commentary

Portfolio Composition

2024 Thoughts

Performance

General Commentary

It’ll be fun to talk through this looking at both 2022 and 2023 as a whole, but man we are really just in a roller-coaster market with an extremely high flow of information that makes it feel like SVB happened half a decade ago (to me at least)!

Since the start of 2022, my benchmark of QQQ is up 2.6% versus my portfolio up 36.8%. Personally, that continues to get me so jacked up and excited about individual stock picking because of the incredible dispersion we’ve seen under the hood of indexes over really the last decade.

So many extremely high quality companies, ones that have actually executed in the way they needed to driving accelerating incremental margins on a path to sustained profits, are at price levels they saw coming on 2,3,4 years ago (DexCom & Insulet best examples for my port). It’s not the company’s fault market participants were bidding those stock up to insane multiples, and no one was holding you hostage to buy it there (I say this extremely inward)! Again, this gets me extremely excited about hunkering down on the long term prospects of stock picking and having a fluid portfolio framework where needed.

Coming into the year my portfolio was a bit more defensive than it had been in past with a large portion in various ETFs still, but was ~104% net long (I was in net leverage for most of 2022 somehow lol). The first half of my year was unfortunately spent cleaning up my personal balance sheet as you can see below of my net deposits/withdrawals.

Overall, I’m very happy with how my portfolio flowed this year. I do think there was a period in time from March - June I probably was doing way too much with too little conviction behind my moves, which is reflected in the performance.

Reading Lessons From The Titans around July made probably the biggest impact on me this year, as I then really opened up to looking at industrials and other areas of the market I hadn’t had much interest in previously. Other books that I highly recommend that I finished this year:

Built From Scratch - Home Depot Story

The Everything Store - Amazon Story

Super Mario - Nintendo Story

Made From Scratch - Texas Roadhouse Story

Billion Dollar Lessons - Less exciting version of Lessons From The Titans imo

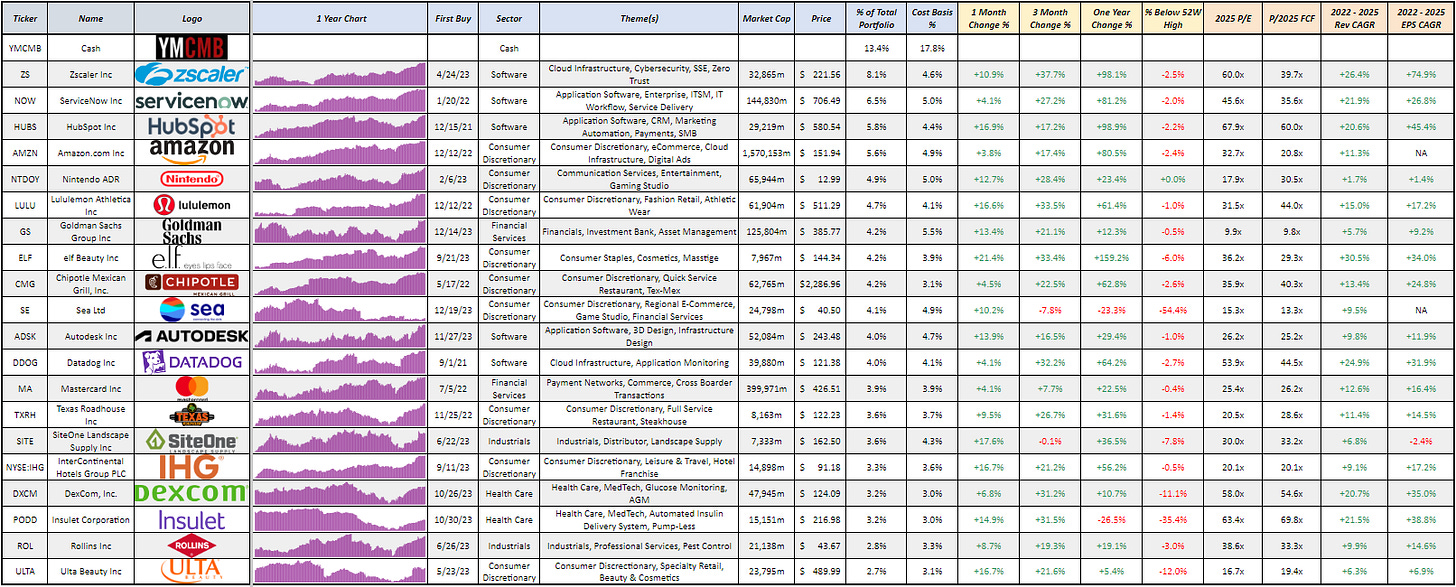

I now sit with a portfolio that touches quite a few different areas across five main sectors: Tech, Consumer Discretionary, Financial Services, Health Care & Industrials; but those first two categories account for ~66% of my portfolio as of today. By the time Q4 rolled in, my portfolio felt the most well rounded in terms of diverse, high-quality companies after finally diving into Health Care (coming out owning DXCM 0.00%↑ PODD 0.00%↑ IDXX 0.00%↑).

Where the luck of my 2023 comes in, I got laid off from my sleepy public SaaS sales job (I know, hang with me) late October, where I immediately rolled over my Roth 401k into Roth IRA. Around that time as we well know, the market bottomed with the 10YR hovering above 5%. I put that sizeable amount of money to work and I was able to double the performance of my benchmark QQQ for Q4 (28.2% vs 14.3%) where I also got the lift of QQQE o/p of QQQ.

The personal story ends well where I’ve accepted a new job at a late stage private company in the vertical software industry, in a better title, pay and opportunity. Ironic part about the whole thing is the company I got laid off from reported earnings the next week and got so hard into the earths core.

No reason to be bitter moving forward, I’m quite happy with how things worked out and extremely excited to ramp up my saving rate in 2024 after a terrible 2023 in that regard, which I argue should be a 26-year old investors biggest priority before stock-picking/research!

Getting to my winners and losers of 2023, I like many others have come to the realization that arguably the best strategy over this “new market” is simply waiting for dislocated opportunities in the market that either present themselves during earnings season or from deteriorating investor confidence on competition, disruption or whatever narrative is currently at large.

This “opportunistic capital” style approach is something I really want to continue leaning into with the success I’ve seen with it, but the key is to be genuinely patient (extremely hard).

Winners:

ZS - The shining example of opportunistic capital approach for myself this year, where the narrative on cyber and ZS at large in that late April time period was noticeably extremely negative with the stock cratering. This was a company I actually had never owned previously but had always admired since they were heavily enterprise focused and far along with Gov/Defense. I will say I got pretty damn lucky here since a week after I scaled into my position, ZS pre-announced earnings at the beginning of May and the stock has been off to the races since.

NOW - Nothing too impactful to add on any of my growth stocks I held coming into this year. My longstanding love for application software did work out quite well, as for the most part those outperformed infrastructure this year unless you were directly tied to AI which wasn’t many.

HUBS - Similar message to NOW, but HUBS had some of the most impressive earnings releases on KPIs such as Customer adds this year, maybe only to be rivaled by TOST. I wouldn’t be surprised if this name had one of the better top line outperformances to revenue expectations this year in software, but damn this company couldn’t care less about incremental margins.

Losers:

ENPH - This one is tough for me to do takeaways on. I will say I got pretty enamored by their financial profile and operating strength during 2022 especially, which I think was my first real lesson on truly rate driven stocks for end market demand. In hindsight it was pretty obvious this stock was going to get killed through the hiking portion of cycle, but I decided to average down instead of revisit once the thesis changed with Q1 earnings because I believed management when they said Q2 23 massive guide down was one-time inventory channel correction. To make matters worse, I sold the stock most of the stock at 120 and 90 before rates story turned back around. Sad! Never want to look at this ticker again vibes!

NRDS - This is a classic “how did I lose money on this stock” when I look back. Unfortunately was a case of getting shaken out of a stock I did like the prospects of at a reasonable valuation, and now it’s up 75% from where I sold due to a lack of true conviction. Sad!

ATZ.TO - This one I’m pretty happy I had a speed run in with the lesson of retail is hard, and especially fashion. This could’ve been much worse than it was when I entered the stock around February, and sold out completely before their Q2 earnings for a -15% booked loss. I feel there are better ways to reflect consumer discretionary than retail and it’s something I’ve continued to challenge myself on. Aritzia is still an extremely high quality “emerging” brand but that doesn’t mean it’s a great investment.

My Portfolio

Thoughts on 2024

I think other people can probably relate, but from the time I started writing this section in November to now, the difficulty of creating this increased by an exponential amount. I’ve never been a doubter of efficient markets and I think the run up even before the Fed Pivot is one of the best examples of that haha!

Part of what I want to write here is to just wait for Q4 earnings and regroup when we get FY guides coming in and be done, but that isn’t very fun for someone who doesn’t take themselves very serious now is it :)

I hold the view that you want to be looking in areas that see accelerating incremental margins (hard to do that without a stable top-line, so I think that gets you to where you want to be in one criteria). I think software companies experiencing general top line/billings reaccel can/will do will but I’m not confident enough to put new money there since most higher growth, semi mature software companies have terrible incremental margins!

Cyclicals is really where my head is at more for what I described above, and I also want to focus on companies with a market cap under $25B, ideally <$10B but above $3B. I’ve been hitting the screens hard and have had a great time continuing to expand my horizons to new companies, which I think is a pretty smart thing to do here getting prepared for earnings season coming up.

M&A in my view will continue to pick up and I think the semi decent quality wasteland technology cohort will have their time in the sun as consolidation/takeout moves happen. What I would really love to see this year is some damn mergers in SMID tech!

Over the last two weeks of December, I basically took off all the money that flowed in from my Roth 401k rollover at the end of October. I’ve exited quite a few companies that I either don’t have enough conviction in to hold through a cycle, or where I have to be honest with myself in valuations not aligning in certain areas in turn reducing my conviction of a reasonable return.

With this 13% cash position, I’m pretty damn excited to continue researching new companies, hopefully holding tight until earnings season and adjust accordingly from information we get coming out.

My 2024 personal goal is to care about marco news-flow 10% as much as I did in 2023, since I think we’ve generally been given all the information we need. This is obviously within reason, such as if we head into a full on recession where I would definitely want to pause and look around. Saving for that, I plan on keeping things to a micro level this year.

Now, I am of the opinion that things aren’t all of a sudden better in cyclicals and that things will take time. I think current investor excitement for these types of turnarounds (I know I am!) is a bit ahead of itself and will provide a more reasonable area to reflect those viewpoints in the beginning portion of the year. Now the flip side of this is if we get stellar FY guides all bets are off, but I like the R/R of being patient for now with that cash position.

Top Picks for 2024: $NTDOY, GS 0.00%↑, AMZN 0.00%↑, SITE 0.00%↑, ELF 0.00%↑

Current watchlist heading into 2024: TW 0.00%↑, IDXX 0.00%↑, FIX 0.00%↑, BMI 0.00%↑, PDX 0.00%↑, and of course any company down >10% on earnings in my 300+ company watchlist (includes financials, linked on homepage).

Thank you for reading!

I hopefully will be posting two other newsletters in Q1 24 (Sector Breakdown & Earnings Review)

- Sean