In something new, I’ll be highlighting each of my portfolio company’s earnings reports in two newsletters over the quarter off schedule.

I’ve wanted to do something like this for a bit and planned on including company updates of each holding in just one newsletter, but when you go from holding less than 10 companies to now 20, the dynamics change!

The length of each company’s write up section will vary on the amount of KPIs the company discloses and the amount of good insights to share from their numbers. My hope is you’ll get an idea of how the company performed against expectations, the trends behind their numbers, and I’ll also include some quotes of interest from the earnings call.

Here is a rough outline of my earnings season, and how I’ll be breaking up the two editions:

Part 1:

ServiceNow - 1/26, Atlassian - 1/27, Alphabet - 2/1, Bill.com - 2/3, Twilio 2/9, Datadog 2/10, Freshworks 2/10, HubSpot 2/10, Zendesk 2/10

Part 2:

Sprout Social - 2/22, Digital Ocean - 2/24, Zscaler - 2/24, Intuit 2/24, Semrush 2/28, SoFi 3/1, Snowflake - 3/2, Crowdstrike - 3/9, dLocal - N/A, SentinelOne - N/A, MongoDB - N/A

If I had to segment the quality of reports between the nine that have reported so far, it would go as follows:

Great: ServiceNow, Bill.com, Datadog

Good: Atlassian, Zendesk, Twilio, Freshworks, HubSpot

Average: Alphabet

Although I try to stay objective when assessing progress of companies I own, I’m no doubt biased when I say I honestly thought all of the reports were really solid and brought pockets to get really excited about in each.

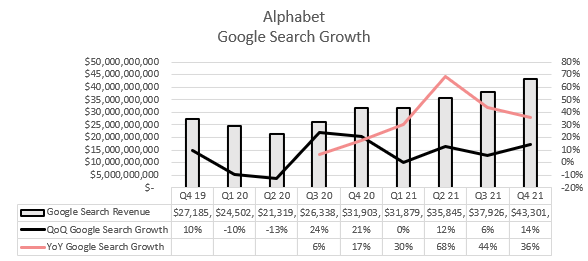

The only reason I dinged Alphabet is because they historically don’t give guidance so we’re a tiny bit blind into Q1 unlike with other companies, and I would’ve liked to seen a bit more out of Cloud, but that’s very much nitpicking.

Now lets get into individual reports!

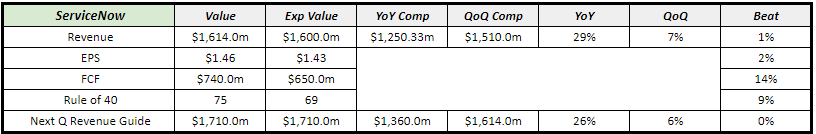

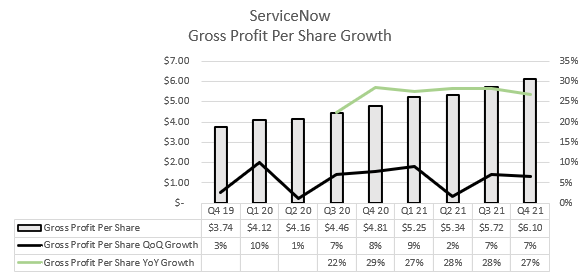

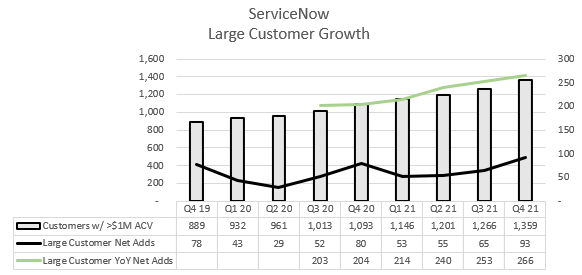

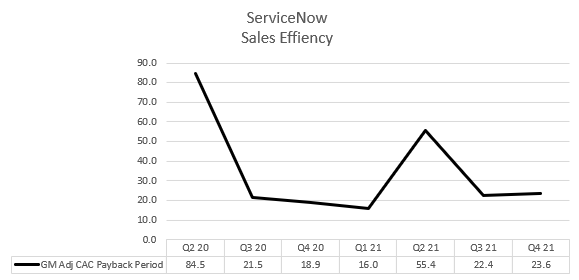

ServiceNow

The Numbers:

The Trends Visualized:

Earnings Call Quotes:

ServiceNow is uniquely positioned. We're growing like a fast-moving start-up with the profitability of a global market leader. We're on a clear growth trajectory to $15 billion plus by 2026.

- CEO Bill McDermott

Together, these businesses, IT, customer, employee, creator, represent a next-generation suite built on a pure-play born in the cloud architecture. Our intuitive consumer-grade experience is expanding adoption of this platform everywhere, already 70 million users strong. This has created a unique moat in terms of ServiceNow's strategic relevance in the enterprise.

- CEO Bill McDermott

ServiceNow's ability to quickly respond to the needs of enterprises when and where they require us most is why we've become the trusted digital platform to drive transformation.

It's why our renewal rates are best in class, creating a solid foundation from which we grow upon each year. It's why in 2021, we added more incremental subscription revenues than we reported in 2016.

- CFO Gina Mastantuono

Now on M&A, I want to be really super clear about this. We have no targets on the board for M&A. And the reason for that it is on an organic growth basis, you see the numbers as much as I see the numbers.

The cloud economics are in full flight. And we have engineers that love this company, and they love coming to work every day, whether they're working out of their home or our office. We're all open. And they come in and they create new things.

And they have an idea that they can take, and they have a dream that they can build. When I listen to other engineers in other software companies that want to come over here telling me they spend 90% of their time integrating the past as opposed to innovating the future, it just reminds me of how thoughtful we have to be on M&A.

- CEO Bill McDermott

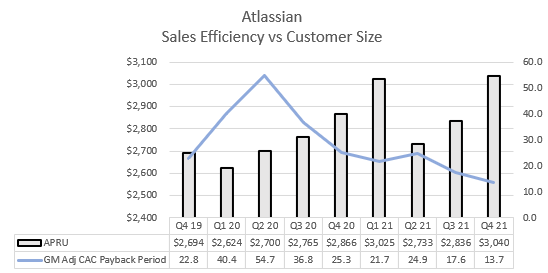

Atlassian

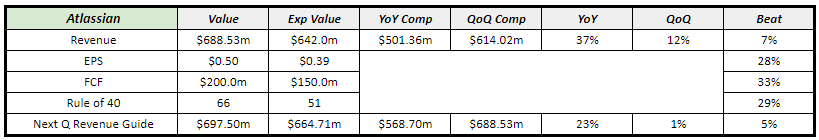

The Numbers:

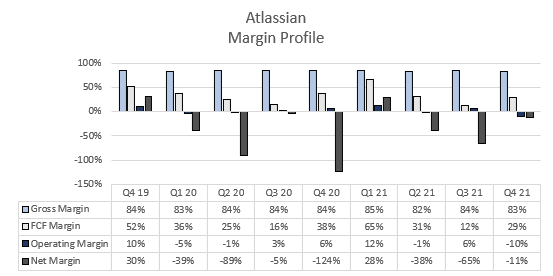

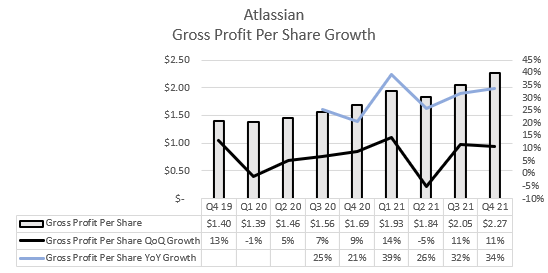

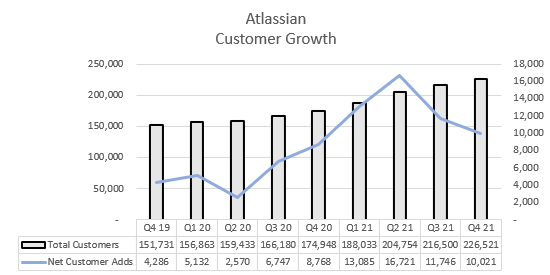

The Trends Visualized:

Earnings Call Quotes:

Cloud apps now make up nearly half of all marketplace apps, and the rate at which customers are adopting cloud apps is outpacing our own cloud products. It's exciting to see our ecosystem grow with such a rapid pace and for us to be able to expand the economy around Atlassian.

- Co-CEO Scott Farquhar

On what product had stood out in 2021:

You know, if I were to pick out one product, it would be JSM.

I think that's just really hitting the mark with customers, a big opportunity for us going forward. That has, of course, given us the confidence to raise our full year subscription revenue guidance to around 50%. That's up from the mid-40s percent that we were talking about 90 days ago.

- Co-CEO Mike Cannon-Brookes

On freemium to enterprise product plans:

You know, this really goes to our overall addition strategy that starts with free, standard, then premium, then enterprise. And we've really got those four editions now pretty much right across our portfolio -- broad portfolio of products.

And I think that's a tremendously important driver. We're seeing customers really get incremental value as they step up that ladder, if you will, of additions. And then we've spoken now for several quarters about how pleased we've been at the relatively low-churn levels and how we've really put effort into minimizing that type of activity.

- CFO James Beer

Partners are critical to our long-term success. What’s more, they see Atlassian Cloud as being critical to their success and are embracing the new opportunities around migrations, sales, and app development it provides. And the numbers bear this out: Cloud sales from our Channel Partners in Q2 were up 131% year-over-year.

- Shareholder Letter

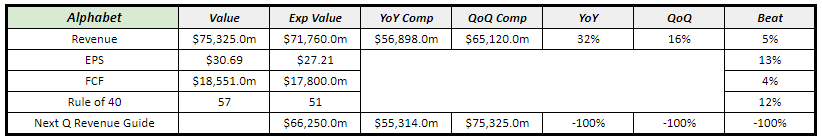

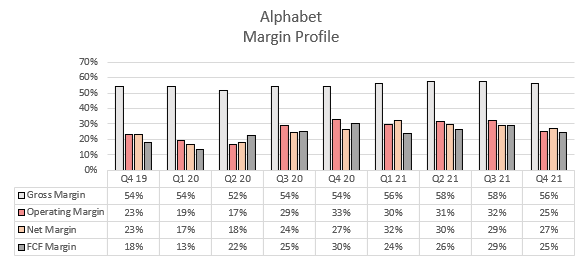

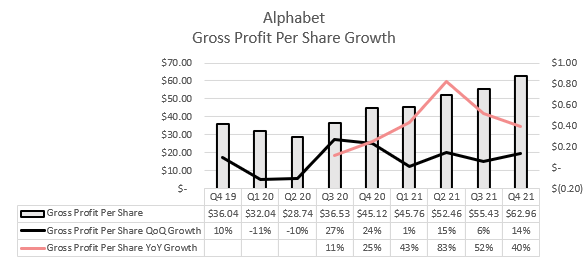

Alphabet

The Numbers:

The Trends Visualized:

Earnings Call Quotes:

Last year, the number of YouTube channels that made at least $10,000 revenue was up more than 40% year over year, and we are continuing to improve support for artists and creators. More creatives than ever are earning money from our non-ads products like Super Chat and channel memberships. And the Shorts fund is now available in more than 100 countries.

- CEO Sundar Pichai

You can see that Google Cloud revenues increased by 47% for the full year 2021 compared to 2020 with GCP revenues continuing to grow at a faster rate than cloud overall. While cloud operating loss and operating margin improved in 2021, we plan to continue to invest aggressively in cloud given the sizable market opportunity we see. We do remain focused on the longer-term path to profitability and over time, operating loss and operating margin should benefit from increased scale.

- CFO Ruth Porat

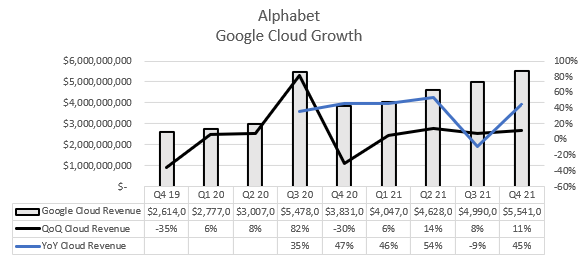

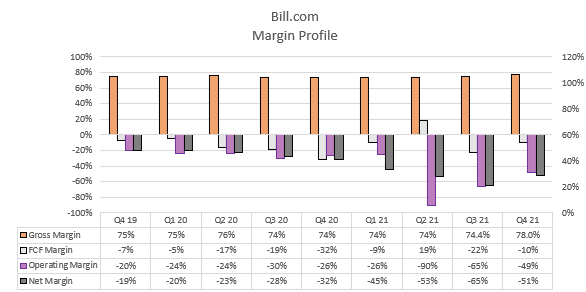

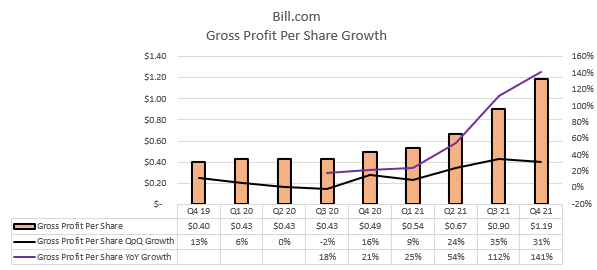

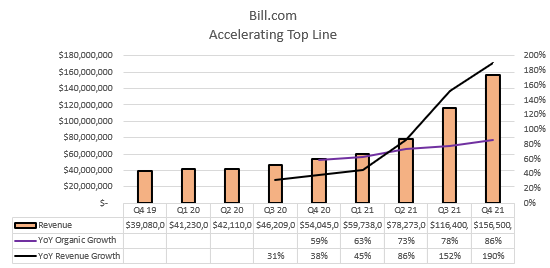

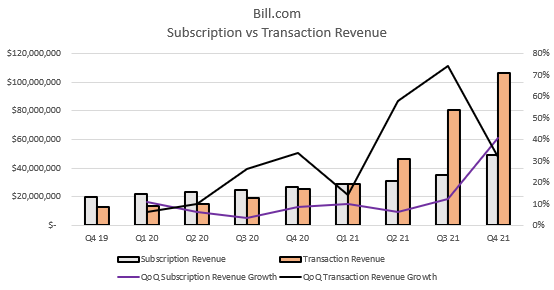

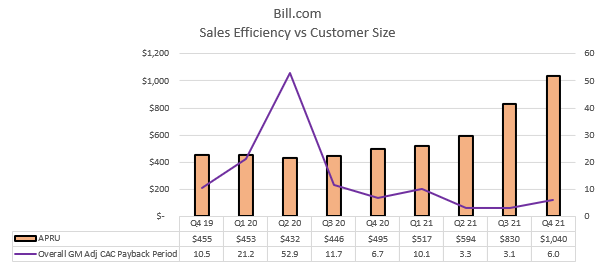

Bill.com

The Numbers:

The Trends Visualized:

Earnings Call Quotes:

We are well on our way to becoming a profitable, multibillion dollar revenue company, delivering the all-in-one platform for small and midsized business financial operations.

- CEO Rene Lacerte

We have partnerships with six of the top 10 financial institutions and more than 5,500 accounting firms, including more than 85 of the top 100 in the U.S. The breadth and diversity of our distribution strategy has enabled us to reach more customers and expand our network to more than 3.2 million members.

- CEO Rene Lacerte

Matt Gardner, CEO and Co-Founder of Hiline, said and I quote, "With Bill.com, we are able to save two-thirds of the time spent on managing paper checks and invoices, which give us more time to provide our clients high-value services. This drives growth for hiline, and it also creates more value for our clients. They can focus more on scaling their businesses while having more financial peace of mind."

- CEO Rene Lacerte

Samuel Arnoff, General Manager of the Manhattan Soccer Club, said and I quote, "Divvy really alleviates our reimbursement process, saving time and reducing frustration. Additionally, I also have real-time visibility into each transaction, and the integration with QuickBooks is seamless. The ease of having multiple solutions in one place also adds value for me. I can count on Bill.com for bill pay and expense management."

- CEO Rene Lacerte

Looking ahead, I continue to be bullish about the opportunity we have to support businesses ranging from sole proprietors to mid-market companies. In the near-term, it remains our priority to deliver features that create a more unified and seamless platform experience. We will also continue to expand our payment offerings, extend our network reach via our diverse ecosystem and scale our relationships with accounting firms and financial institutions.

- CEO Rene Lacerte

The slight decline in net new customers added at Divvy and Invoice2go as expected as we applied Bill.com's more robust underwriting and onboarding criteria to their new customer sign-up flows. We believe this application of our proprietary risk logic will yield higher-value customers going forward.

- CFO John Rettig

And as you can see from our organic business, there's still a long way to go as we continue to drive adoption of some of our newer products, and we expect to be able to continue to grow adoption and our take rate going forward.

- CFO John Rettig

So when we think about M&A, it's not really thinking about M&A, it's about how do we add value for our customers and how do we add value for shareholders. And so we have lots of interest about ways to extend the platform. We've talked about working capital in the past. We've talked about HR and payroll opportunities. I don't know if we've mentioned this, but business insights and analytics. I mean there's lots of things that we can do that will continue to drive and automate financial operations for our customers. And that's ultimately the goal that we have. When we can save customers 50% of the time on their back-office mess, that's super powerful. And the more customers we can reach, the happier that makes me.

- CEO Rene Lacerte

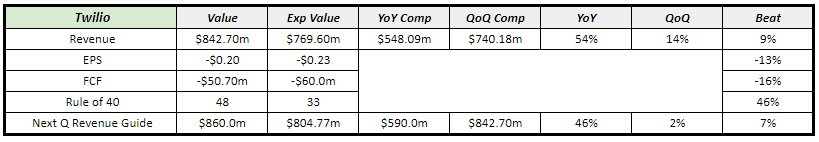

Twilio

The Numbers:

The Trends Visualized:

Earnings Call Quotes:

And what that is leading most companies do is realizing that they need to have these direct relationships with their customers. When I talk to executives of every kind of company you can imagine, understanding a customer, building that complete picture of their customer and then acting on it to improve the outcome of their business, to spend less on marketing, to spend less on advertising, in particular, to increase their retention rates, to increase their -- or decrease their customer acquisition costs and increase the lifetime value,

- CEO Jeff Lawson

With recent Apple IDFA changes, Google’s planned deprecation of cookies, and increased global regulation of customer data, companies need to decrease their reliance on third-party data. Today Twilio Segment manages an enormous amount of first-party customer data but it’s a minimal fraction of the total customer data that’s out there.

IDC forecasts the CDP market to grow to over $3B by 2025, from an estimated $1.5B in 2021. The opportunity to improve how companies engage with their customers using data gets bigger every year as they continue to digitize and we’re just getting started.

We’re in the early stages of leveraging our APIs to provide a broad real-time customer engagement platform with a variety of marketing, sales, and customer support use cases that combines Twilio Flex for the contact center, Twilio Frontline for sales, and Twilio Engage for marketers into a single platform across the customer lifecycle/journey.

- CEO Jeff Lawson

On gross margin outlook:

I think over the time, in medium to long term, we do expect improvements in our gross margin line as well. Obviously, that number has bounced around from period to period in the short term, not the trade-off, but would be also actively made because we like the fact that we're onboarding customers and have an opportunity to grow with them. But very consistent with what Jeff said a moment ago, as we onboard those customers and really leverage the in-and-up strategy and bring them into higher levels of the software stack, I think we have a real opportunity to provide value to customers, and I think that will bring margin improvement for us as a company. And that's why we stand by our 60% loss over time in the gross margin line.

- COO Khozema Shipchandler

On drivers behind gross margin fluctuations:

As you saw on the last page of the presentation disclosures, while all of that is going on, our application services are actually growing at a faster rate. kind of the good problem that we have is that our messaging business organically also grew 52% last year.

And so, that's just kind of trade-off that we want to make. As long as we continue to generate high gross profit, as long as we can generate great growth off of application services in Segment, we feel confident that, over time, we will be able to grow into that 60%-plus range that I talked about earlier, and we have a lot of confidence in that. But in the short term, you will see a bounce around a whole bit up and down. And again, in our disclosures, we probably -- we tried to give you some sense of, you know, how the A2P fees and stuff like that impact as well.

- COO Khozema Shipchandler

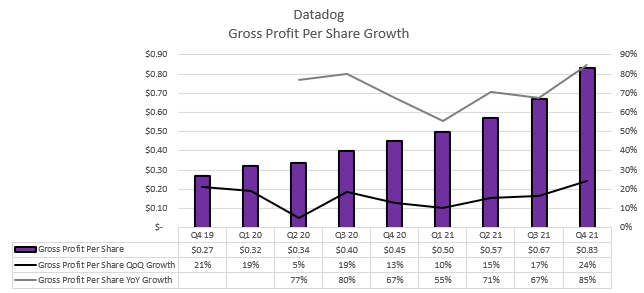

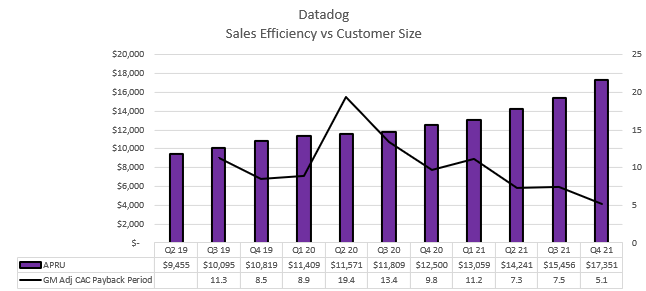

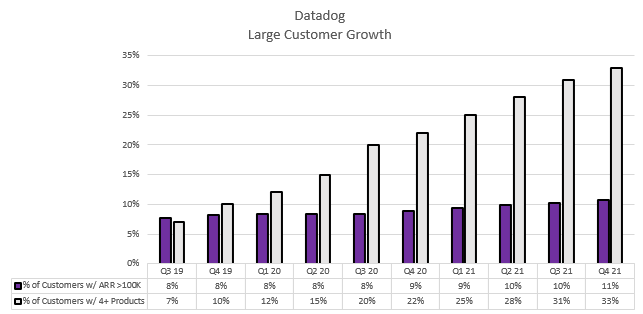

Datadog

The Numbers:

The Trends Visualized:

Earnings Call Quotes:

Year-over-year growth of infrastructure monitoring ARR has accelerated in Q4 compared to Q3. In addition to that, APM suite and log management products continue to be in hyper-growth mode. And we're very pleased to report that our newer products added about $100 million in ARR in 2021. These are the newer products we launched in 2019, which excludes core infrastructure, core APM, and log management

- CEO Olivier Pomel

Next, we had an up-sell to add figures of ARR with a major financial infrastructure company. This customer has consolidated multiple monitoring tools in Datadog, helping them ensure stability and support growth. This customer estimate savings of 45% by migrating to Datadog. And the up-sell also includes new products such as Cloud SIEM, Cloud Workload Security, and Cloud Security Posture Management. And this customer now uses 10 Datadog products.

- CEO Olivier Pomel

And our dollar-based net retention rate remained above 130% for the 18th consecutive quarter. Our customers expanded the usage of our largest products meaningfully. Infrastructure monitoring year-over-year ARR growth accelerated from Q3 levels. And the APM suite and log management products remain in hyper-growth mode. We also saw strong ARR growth in each geographical region. North America, EMEA, and APAC all accelerated on a year-over-year basis compared to Q3.

Our go-to-market teams delivered a strong quarter in new logos and new logo ARR. We added 1,300 customers sequentially, a new record for us. And new logo ARR was also a record and included our largest ARR land ever, as Olivier discussed earlier. Remember that given our usage-based revenue model, new logo wins generally do not immediately translate into meaningful revenue.

- CFO David Obstler

On consumption-based model at scale:

So the way we deal with that is -- and again, the backdrop there is the explosion of data volumes. So if data volumes at our customers grow a lot faster than the top line, at some point, you can't grow what you charge for that linearly with the data volumes. The way we deal with that is we give them more and more options.

And those options are differentiated technologically so that we can keep developing new ways of storing the data, different types of data in different ways for different periods of time and that customers, they can choose what they want to use out of that.

- CEO Olivier Pomel

On Datadog security traction:

We see the traction, right? So we mentioned on the call, we have thousands of customers on security products. And so the adoption is there. It's happening across our products. We have a number of products we started charging for in Q4, such as cloud workload protection, for example.

It's still possible we have to make changes to the go-to-market motion and specialize the teams and do a number of other things. I would say it might come in a bit later when customers are -- start embarking on the same standardization motion for security as they do right now with us for observability. But today, we're very pleased with what we see in terms of the fit and the adoption of those product. This is happening according to plan, I would say.

- CEO Olivier Pomel

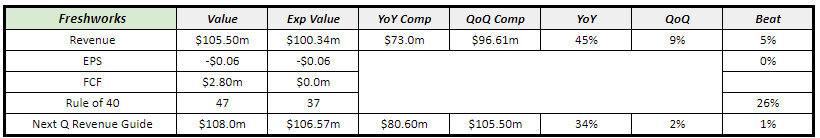

Freshworks

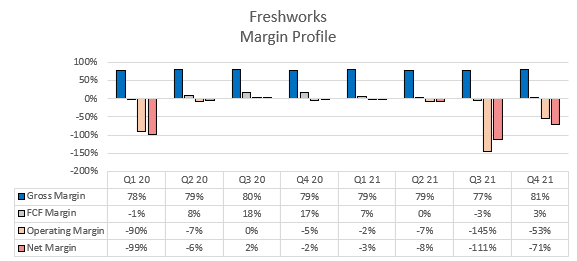

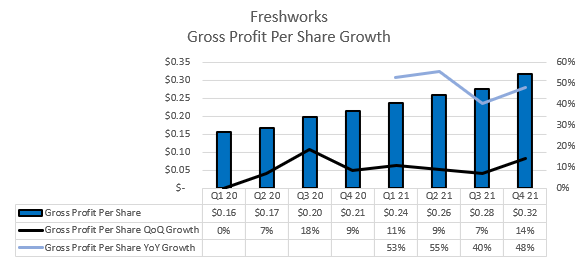

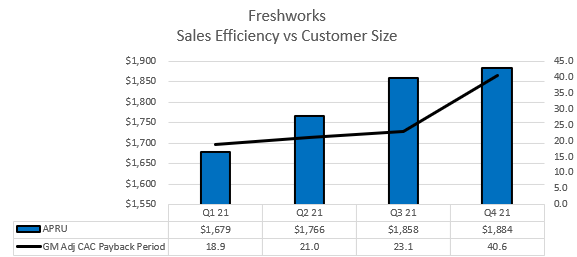

The Numbers:

The Trends Visualized:

Earnings Call Notes:

Our inbound motion continues to be an efficient high-velocity go-to-market engine catering to SMB and mid-market customers. We also saw positive momentum on multi-product adoption. As of Q4, 21% of our customers use more than one Freshworks product.

- CEO Girish Mathrubootham

For 2022, we are prioritizing customer experience and CRM product enhancements around these changing market trends ... Our second priority is our expansion beyond the ITSM market.

We plan to continue investing in our new platform, which provides shared services and enables rapid product innovation. This includes allowing our customers to extend and integrate our products with their business processes and continued work toward our vision of a unified CRM product to break down the silos across marketing, sales, and support.

- CEO Girish Mathrubootham

In Q4, our non-GAAP gross margins maintained an impressive rate of nearly 83%. This is the result of the ongoing efficiencies we were able to realize in our infrastructure spend and an improved revenue mix from higher-margin products, especially in the second half of the year.

- CFO Tyler Sloat

On forecasted higher spend in 2022:

One -- number one, we think there's a huge opportunity in front of us. And part of the reason to go public was to make sure that we have the resources and capital to go capture that opportunity. And we said, hey, as long as we think we can do it efficiently, we're going to do so, which we are. But there's a couple of other nuances as well. Second, we also think that some things are going to come back to pre-COVID levels in terms of travel and facilities.

- CFO Tyler Sloat

On Freshworks headcount location mix:

So total headcount, we ended the year just over 4,600 headcounts globally with the majority, 4,000 of which are in India.

- CFO Tyler Sloat

On competitive landscape:

In the CX market, I think we see Zendesk and Salesforce Service Cloud predominantly, and we continue to see them.

On the ITSM side, we feel really that's our strongest opportunity right now as we are -- seeing that we are a credible alternative to ServiceNow. And we continue to see ServiceNow, and their focus is really on the large enterprise. We are squarely focused on being that mid-market alternative.

In sales and marketing, I think it's still early on, but we see good validation for that story of the unified customer. We are still on that journey, and we see HubSpot and we see all the other stand-alone CRM players as well.

- CEO Girish Mathrubootham

On churn progression:

Churn being half of it where we had previously talked about kind of being the low 20s to high teens in terms of churn, and now we're solidly in the high teens. We're not ready to say, hey, you should model out more than the kind of the 110 to low teens in terms of net dollar retention run rate, but things are going in the right direction. And we feel really good about it. We've made some great progress in terms of churn.

Our Freshdesk product had the best churn quarter it's ever had. Freshservice was already at great churn levels. And the investments we made in the customer success group over the last year are truly starting to pay off. And so we'll update that as we think you guys should be modeling something different, but it feels really good right now.

- CFO Tyler Sloat

On ARR by currency mix:

Yeah. So we do have some currency impact. We've got about 32% of our ARR that's in non-USD kind of currencies.

- CFO Tyler Sloat

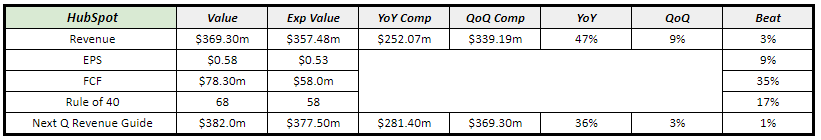

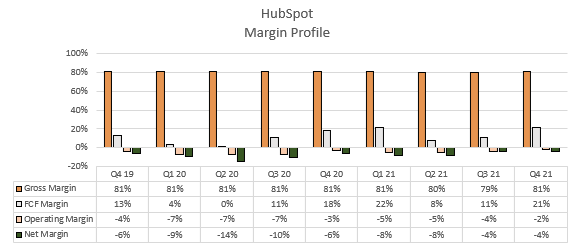

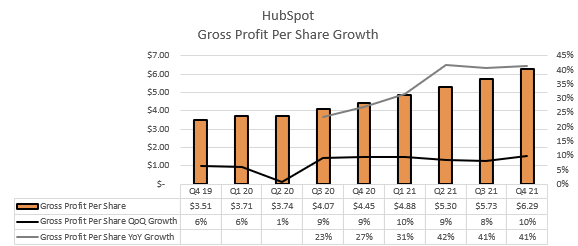

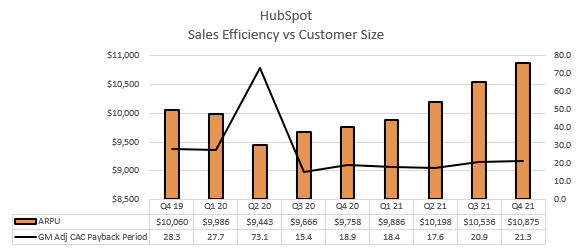

HubSpot

The Numbers:

The Trends Visualized:

Earnings Call Quotes:

We also introduced a new lever for growth with payments and commerce and believe that commerce-enabled CRM can drive growth for our customers. I'm really thrilled to share that HubSpot Payments is now available to all U.S. customers, with our target segment being companies with fewer than 100 employees. Customer feedback is validating our hypothesis that a commerce solution is much more powerful when it's natively built inside of a CRM.

We know that native payments are widely important for SMBs to grow their businesses online, particularly when it comes to having commerce context embedded in CRM. This actually ensures that all front-office teams have visibility into their interactions with the customer. While it's very early days, we're encouraged by the momentum we're seeing with our payments offering.

- CEO Yamini Rangan

Multi-hub adoption now accounts for 60% of our customer base, compared to 34% in 2017, which is a powerful indicator that our customers are seeing value in adopting HubSpot across multiple parts of their business.

- CEO Yamini Rangan

On Operations Hub enterprise adoption:

And I was also very pleased to see that 40% of Operations Hub new bookings in Q4 came from that enterprise tier that we recently launched. And the Enterprise edition is all about reporting and driving insights so that our customers who are adopting the entire CRM suite can see a lot of those insights will continue to grow. Data sets is a very key feature there. We're definitely seeing data sets, as well as the advanced reporting within the enterprise edition, drive momentum.

- CEO Yamini Rangan

On Payments feedback now in GA:

First off, we were very excited about Payments going GA, but it's very, very early days.

And at this early stage of a new product introduction, I'm looking for a couple of things. I'm looking for product market fit and the validation of our early hypothesis. And that's exactly what we are hearing from early customer feedback.

So we went in with a couple of big hypotheses. One is that embedding payments into CRM will spur B2B e-commerce, and we're seeing that. The second big hypothesis we have is commerce context in CRM is going to add a ton of value for our customers.

- CEO Yamini Rangan

On Payments guidance outlook for 2022:

That said, we do not -- we did not embed any material revenue or COGS associated with Payments in our '22 guidance. So it's neither -- we didn't see meaningful results in Q4 and we don't expect it to be a meaningful revenue driver in 2022.

- CFO Kate Bueker

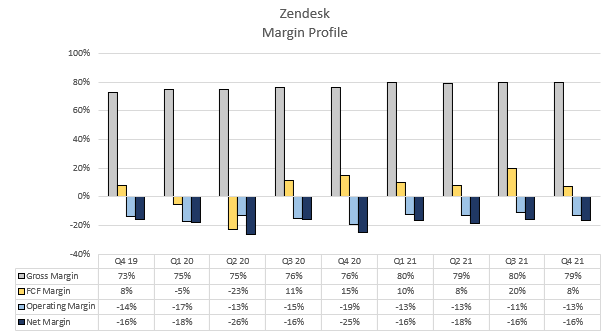

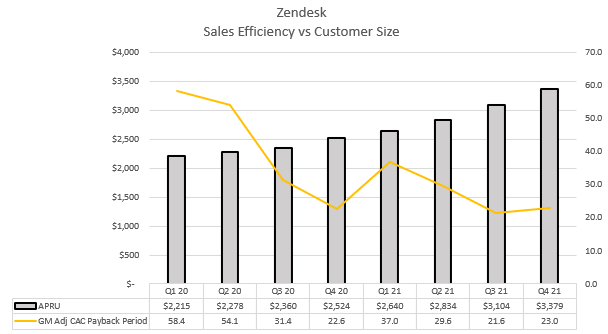

Zendesk

The Numbers:

The Trends Visualized:

Earnings Call Quotes:

In just 11 months since we launched the Zendesk Suite, it has grown to 35% of our annual recurring revenue. That's a $500 million annual business from customers that stay longer and expand at higher rates. New and renewing customers are using Suite because it has powerful functionality that is easy to implement. 90% of our bookings are from new customers are on the Suite product, and Suite accounted for nearly 60% of our total bookings during the fourth quarter.

- CEO Mikkel Svane

We've had a lot of conversations with our investor community over the last few weeks. They've been really good to have, even if they weren't always super comfortable.

We appreciate everyone's willingness to dig in and to engage. Open discourse is how we really get clear about perspectives and expectations. It's how we correct any misconceptions out there. And most importantly, it's how we make sure everyone knows exactly why we are so committed to the vision and the plan we have outlined for Zendesk and Momentive.

- CEO Mikkel Svane

As more of our ARR comes from Enterprise customers and customers on Suite, we've seen meaningful improvements in the fundamentals of our business.

New customers this quarter continued to generate 10x the ARR as compared to the ones that are churned off on our discontinued plans. All of this leads to a more predictable business that is well positioned for continuing strong growth over the long term.

- CFO Shelagh Glaser

On why 90% of new customer bookings go to Suite, but still only 60% of total bookings:

I would say it's all natural behavior that we have customers that are -- that know and are very specific about what they want and don't have Suite in their plans right now. And we also, of course, working with a lot of the customers about the proper timing of moving to the Suite because there's a little bit of a slight bit of change management in the organization. But there's no other kind of -- there's no other big issues that are preventing customers from moving to Suite.

- CEO Mikkel Svane

On focus of investments for 2022:

So I think one of the biggest things we're investing is that Enterprise motion that Norm talked a lot about at the Investor Day. We think the opportunity there is tremendous. And if you look at the kind of the progress we've already made, we think we can accelerate that progress.

We're also making large investments in our reliability. That's across the board for every customer, but obviously, even more important for enterprises as we're helping serve our consequential workflow for them.

And then we're obviously doing investment, I mentioned even putting some investment into compensation because as some of the earlier questions, it's a competitive market. We want to make sure that we're properly investing in our talent.

- CFO Shelagh Glaser

On dynamic of continued net losses of customer logos as transition of Suite continues in 2022:

So I think I mentioned also in my prepared remarks that the new customers we're adding are 10x more ARR than some of those low-end kind of discontinued marketed plans. So we expect that's going to continue through this year. Our expectation was that we may get through that in 2022. But obviously, that's something we'll monitor every quarter. And so as we've said before, this is really a strategy to make sure that we were focusing on those high impact, high return customers.

- CFO Shelagh Glaser

Conclusion

I hope you enjoyed this earnings recap of the companies I own for the Q4 2021 reporting season. My goal was to have a consistent approach to each company and give a good temperature check for anyone unfamiliar with the company on how things are trending and the main things to focus on moving forward.

My earnings season was quite frontloaded which made this edition quite demanding, but fun to put out. My second and final edition will be out sometime in the middle of March after the rest of my holdings have reported.

I’d love any feedback on the style of this newsletter, if it was too long, too short, too much info, would like more info and charts etc. Thank you all for your continued support of the newsletter, it’s something I genuinely appreciate as I inch closer to 1,000 subscribers.

- Sean

Brilliant. Neither too long, nor too short. With the right level of detail and KPI breakdown. I enjoyed this style. For faster reading, I used a text-to-speech :)